Honeywell International (HON) stock soared on Thursday after the multinational conglomerate released its Q3 2025 earnings report. This report started with adjusted earnings per share of $2.82, which easily beat Wall Street’s estimate of $2.56. The company’s adjusted EPS also increased 9% year-over-year from $2.58.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Honeywell International reported revenue of $10.41 billion during the quarter, which was another beat compared to analysts’ estimate of $10.15 billion. The company’s revenue also grew 7% year-over-year from $9.73 billion. This revenue growth came from a 12% increase in Aerospace Technologies sales, a 1% increase in Industrial Automation sales, and a 7% increase in Building Automation sales. The company’s revenue growth was partially offset by a 2% drop in Energy and Sustainability Solutions sales.

Honeywell International stock was up 4.54% in pre-market trading on Thursday, following a 1.18% drop yesterday. The shares have decreased 7.1% year-to-date and 1.19% over the past 12 months.

Honeywell International Guidance

Honeywell International updated its outlook for the full year of 2025 in its most recent earnings report. The company now expects adjusted EPS to range from $10.60 to $10.70, alongside revenue of $40.7 billion to $40.9 billion. Its previous guidance was for adjusted EPS of $10.45 to $10.65 and revenue of $40.8 billion to $41.3 billion. For comparison, Wall Street expects adjusted EPS of $10.54 on revenue of $40.88 billion in 2025.

Vimal Kapur, Chairman and CEO of Honeywell International, said, “Looking ahead, we are well positioned to continue building on our momentum and value creation efforts in the fourth quarter. Today, we are raising our full-year 2025 adjusted earnings per share guidance even while separating Solstice Advanced Materials at the end of October. We will remain focused on our compelling opportunities to deliver outcomes-based solutions to customers and are encouraged by the recent execution of our connected offerings through our Honeywell Forge platform, driving increased recurring revenue in our portfolio.”

Is Honeywell International Stock a Buy, Sell, or Hold?

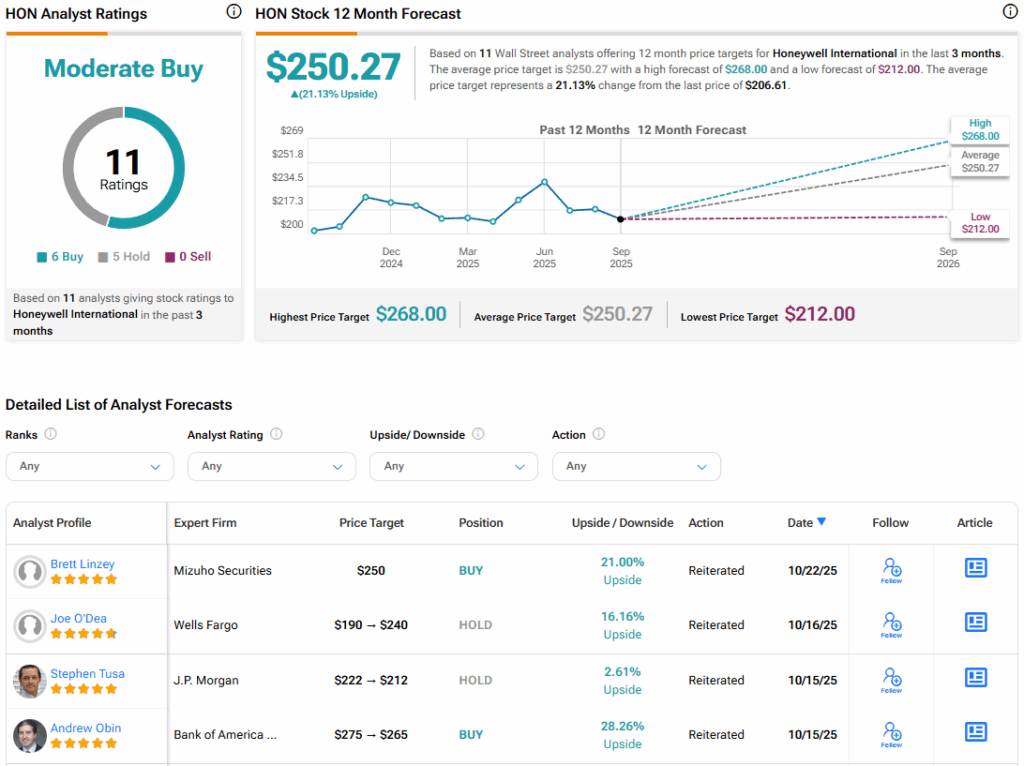

Turning to Wall Street, the analysts’ consensus rating for Honeywell International is Moderate Buy, based on six Buy and five Hold ratings over the past three months. With that comes an average HON stock price target of $250.27, representing a potential 21.13% upside for the shares. These ratings and price targets will likely change as analysts update their coverage after today’s earnings report.