Shares of D.R. Horton (NYSE:DHI) got a nice bump in today’s trading session. This can be attributable to the homebuilder’s Q2 fiscal 2023 earnings and revenue report, which beat Wall Street expectations. The company posted an EPS of $2.73, beating analyst predictions of $1.93, and revenue hit $7.97 billion, well above the anticipated $6.48 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Chairman Donald Horton attributed the strong results to a boost in housing demand during the quarter, even in the face of rising mortgage rates. Investors were further impressed by the company’s FY23 revenue forecast of $31.5 billion to $33.0 billion, which towers over the $28.5 billion consensus.

The company’s net sales orders surged by a whopping 73% from Q1, totaling 23,142 homes with an order value of $8.6 billion. Although this number is 5% lower year-over-year, CEO David Auld remains optimistic, stating during the conference call that the spring selling season is off to a promising start. D.R. Horton is focusing on driving new sales by offering incentives, as higher mortgage rates are keeping existing home listings low.

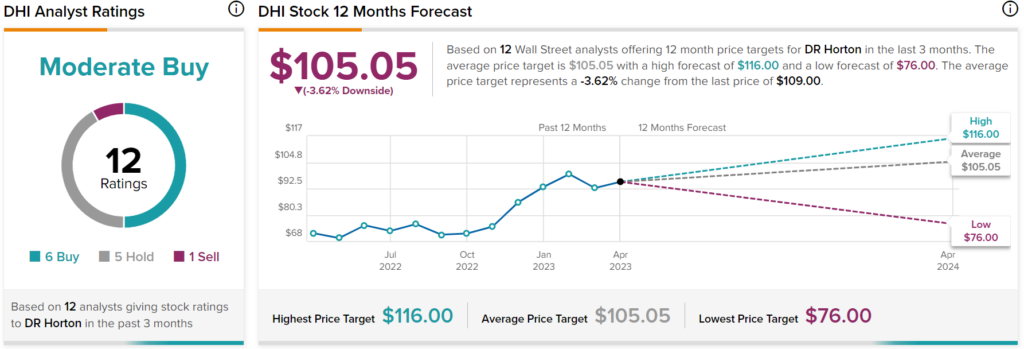

Overall, Wall Street has mixed feelings about DHI stock as analyst consensus rates it a Moderate Buy based on six Buys, five Holds, and one Sell assigned in the past three months.