Shares of home improvement retailer Home Depot (NYSE:HD) are in the limelight today after the company provided an update on its strategic objectives while also reaffirming its fiscal 2023 outlook.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For fiscal 2023, the company expects its top line and comparable sales to drop in the range of 2% to 5% as compared to the prior year. EPS for the year is anticipated to decline in the range of 7% to 13%.

Additionally, in its market stability base case, Home Depot now expects the home improvement market to grow in low-single digits with sales rising in the range of 3% and 4%.

The company’s Executive Vice president and Chief Financial Officer, Richard McPhail commented, “While the base case assumes share capture, we are not ruling out a case for even higher growth. In our accelerated growth case, we would expect sales and earnings per share to grow faster than the market stability base case.”

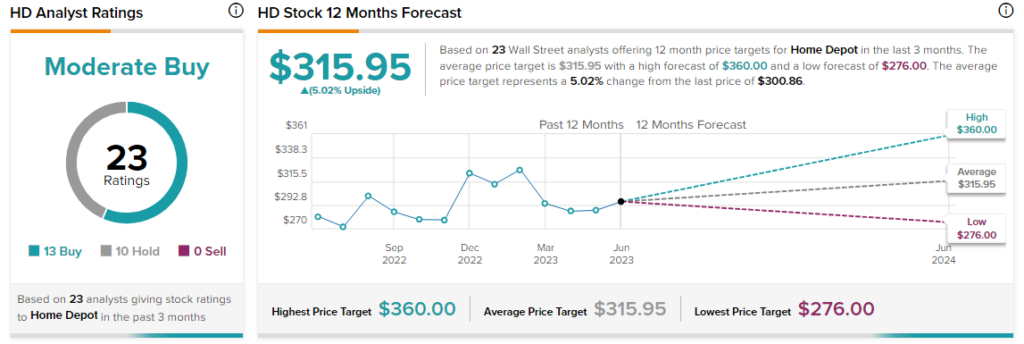

Overall the Street has a $315.95 consensus price target of Home Depot alongside a Moderate Buy consensus rating. Shares of the company have risen from $282 lows last month to the present $301 level. The double bottom formation over the past few weeks suggests more gains could be in the offing for investors.

Read full Disclosure