Shares of home improvement retailer The Home Depot (NYSE:HD) are in focus today after it posted better-than-anticipated second-quarter numbers. Despite a 2% year-over-year decline, revenue at $42.92 billion landed past expectations by $690 million. Additionally, EPS at $4.65 too scaled past estimates by $0.20.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In Q2, Home Depot continued to see pressure in big-ticket, discretionary categories with comparable sales in the U.S. declining by 2%. Further, while average ticket size remained largely unchanged at $90.07, sales per retail square foot dropped by 2.3% to $684.65.

For the full-year 2023, the retailer expects sales and comparable sales to drop in the range of 2% to 5% over the prior year. It expects operating margin to hover between 14.3% and 14% alongside a 7% to 13% drop in EPS.

Importantly, the company also announced a new share repurchase program to the tune of $15 billion today.

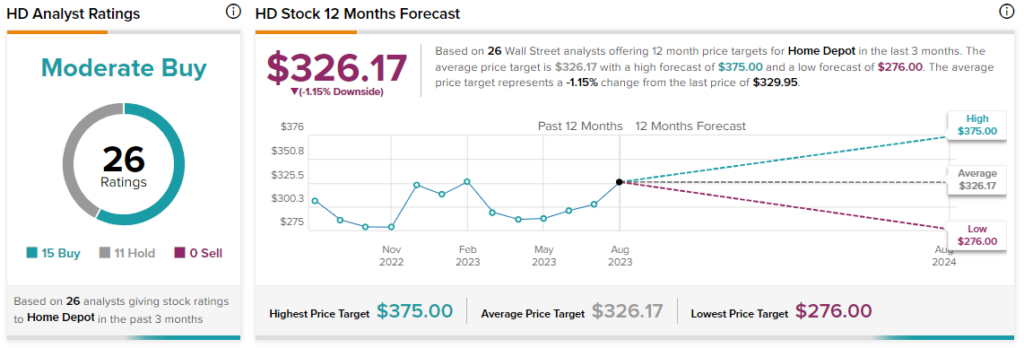

Overall, the Street has a $326.17 consensus price target on Home Depot alongside a Moderate Buy consensus rating. Shares of the company have gained nearly 4.8% over the past month.

Read full Disclosure