The automotive sector confronts a range of challenges, encompassing pricing dynamics, affordability concerns, labor issues, and investment considerations. These are the very same challenges that Ford (NASDAQ:F) is also grappling with.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

However, while the auto giant is trying to increase its capital efficiency, considering execution and quality challenges, UBS analyst Joseph Spak thinks the work needed to be done in addressing these challenges might be more severe than at some peers.

“Though we like CEO Farley’s vision and direction for the future of Ford,” said the analyst consequently, “we believe it could take a number of years for the benefits of those plans to be realized.”

Spak sees challenges ahead that could impede progress. For one, compared to the company’s plans, the new UAW labor contract was meaningfully above (~2x) its expectations. “Ford is looking to tackle that headwind and take cost out, but we believe the surprise vs. base plan means identifying some savings initiatives may only be getting started and cost out could take time to realize,” Spak opined.

Moreover, the company is faced with a “stubborn headwind” in warranty costs, which through Q3, have reached $1.7 billion.

Additionally, the company is not slated to launch its Gen 2 EVs (a clean-sheet approach) until 2025/26, while GM’s clean-sheet Ultium platform enjoys a head start. Although GM has encountered its share of challenges with the Ultium platform, it has gleaned valuable lessons from these experiences. “Given we’ve seen a multitude of EV launches across the industry have issues, it’s not a certainty that F’s Gen 2 product doesn’t face the fate others experienced,” Spak commented on this matter.

The unfavorable GM comparisons continue with Spak seeing “limited upside” to his F estimates over 2024 and 2025, yet showing a preference for GM, given its “potential for more earnings upside.”

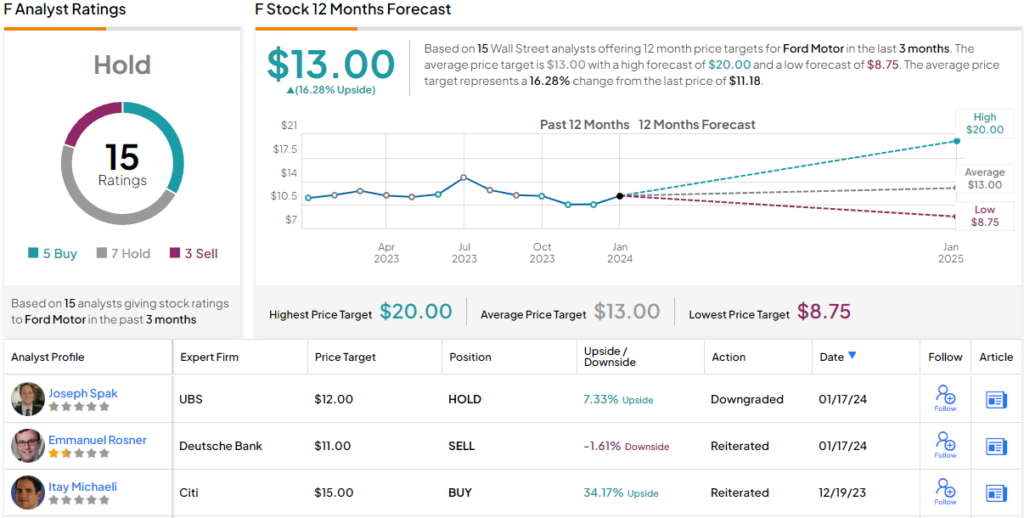

The result of all the above is that Spak downgrades Ford shares from Buy to Neutral, although his $12 price target does remains intact. That figure suggests the stock is set to climb 7% higher over the coming months. (To watch Spak’s track record, click here)

Overall, the F bulls and skeptics are evenly matched on Wall Street and are joined by a couple of bears; based on 6 Buys and Holds, each, and 2 Sells, the analyst consensus rates the stock a Moderate Buy. The average target currently stands at $13, implying shares will post growth of 16% over the one-year timeframe. (See Ford stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.