You could forgive Lucid Group (NASDAQ:LCID) investors for thinking they might have been hallucinating on Monday. After a sustained period of merciless share losses, the stock saw out Monday’s trading up by 27%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

So, what was behind the change in fortune? The stock appeared to be on the move following the announcement that the EV manufacturer has entered into a three-year materials agreement with Ma’aden Rolling, a producer of aluminum sheets.

Ma’aden Rolling operates as a subsidiary of the Saudi Arabia Mining Co., a government-owned entity. It should be noted that Lucid is majority-owned by the Public Investment Fund of Saudi Arabia.

Ma’aden Rolling has the capacity to manufacture approximately 460,000 tons of high-quality aluminum sheets annually. The materials agreement between Lucid and Ma’aden Rolling should bolster Lucid’s U.S. manufacturing capabilities.

It remains to be seen if Monday’s gains can be sustained, although in general, RBC analyst Tom Narayan thinks it will be an uphill struggle for the company to convince investors to get on board.

Lucid delivered 1,734 vehicles in Q4, amounting to another quarter in which the company hadn’t eclipsed the 1,932 delivery “high water mark” set in 4Q22. “Lucid is demand constrained,” says Narayan, “not supply constrained.”

Narayan opines that despite Lucid’s product superiority in various aspects compared to the competition, the company faces challenges with low brand awareness and has made only modest strides in expanding its customer base.

The company will announce its full Q4 results on February 21 when all eyes will be on the 2024 production guide. Narayan is not especially optimistic here, modeling 12.4k units, some distance below the Street at 14.3k. That said, given low expectations, Narayan thinks his forecast might be enough to please investors. “We expect Lucid to approach the 2024 guide with more conservatism after missing its 2023 guidance, so we expect guidance in the 11-12k range,” Narayan said. “12.4k units represents 47% growth, and even though this is below consensus, we believe would be positively received by investors.”

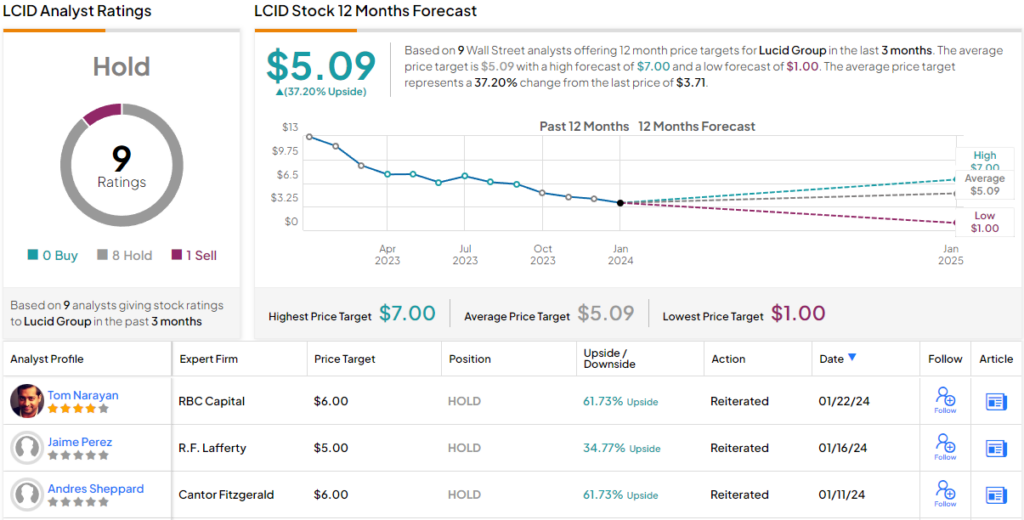

All in all, Narayan is staying on the sidelines with a Sector Perform (i.e., Neutral) rating on Lucid shares. But the analyst might as well have just said Buy, though, given his $6 price target suggests a one-year returns of ~62%. (To watch Narayan’s track record, click here)

It’s a similar story amongst most of Narayan’s colleagues; the stock gets a Hold consensus rating, based on 8 Holds vs. 1 Sell. However, the average target stands at $5.09, suggesting the stock will climb 37% higher in the months ahead. (See Lucid stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.