It’s safe to say Tilray’s (NASDAQ:TLRY) fiscal third quarter earnings did not chime well with investors who sent the Canadian cannabis producer’s shares down by 20% in the subsequent session.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Specifically, revenue climbed by 29.3% year-over-year to $188.3 million yet missed the consensus estimate by $10.03 million. Adjusted EBITDA reached $10.2 million vs. last year’s $13.3 million and while the net loss per share improved from ($1.90) in the same period a year ago to ($0.12), the figure still fell short of the Street’s forecast by $0.07.

Moreover, looking ahead, the company reduced its F24 EBITDA outlook to the range between $60-63 million from the prior $68-78 million range. And given the delayed timing for collecting cash on various asset sales, the company no longer anticipates generating positive adjusted free cash flow in F24.

On a positive note, should cannabis get rescheduled from Schedule 1 to Schedule 3 in the U.S., the company is in a good position to enter the US market. The rescheduling change would enable Tilray to offer imported medical cannabis of pharmaceutical quality, which would be available through doctor prescriptions.

“However,” says Piper Sandler analyst Michael Lavery on this issue, “even if cannabis were to be rescheduled, it is unclear what any regulatory structure may look like, and FDA approval could be required for medical use, which may prove a lengthy process. Product registrations in other countries can take 4-6 months, but it is unclear what the US may require.”

While Lavery believes Tilray’s direct access to the EU differentiates it from the competition, the analyst thinks cannabis stocks are destined to perform according to US regulatory expectations. And that remains a problem for now as the US regulatory outlook is “unclear,” and there is “no clarity on how any potential rescheduling of cannabis in the US may take shape.”

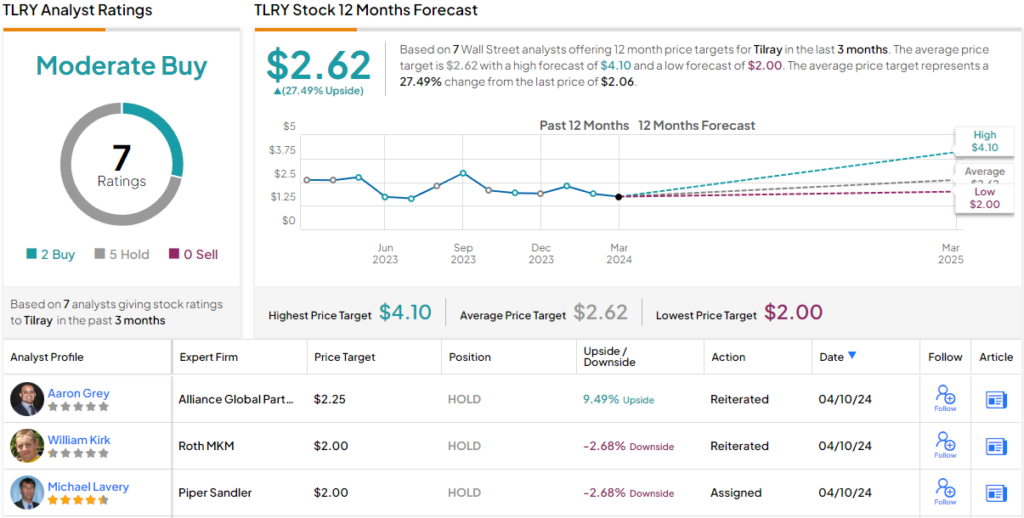

To this end, Lavery reiterated a Neutral rating on TLRY shares and kept his price target at $2, suggesting the shares will remain rangebound for the foreseeable future. (To watch Lavery’s track record, click here)

Of the 6 other analysts who have posted TLRY reviews recently, 4 join Lavery on the fence with Hold ratings while 2 take a bullish stance, all coalescing to a Moderate Buy consensus rating. The average target stands at $2.62, implying the stock has room for growth of 27.5% in the year ahead. (See Tilray stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.