Not about to let other semiconductor giants get away with hogging all the beat-and-raise headlines, on Wednesday all that was on offer in Micron’s (NASDAQ:MU) fiscal first quarter (November quarter) report and guide.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

On the back of five quarters of year-over-year revenue drops, growth was on the menu again as the memory specialist generated revenue of $4.73 billion, amounting to a 15.6% improvement on the same period a year ago, while beating the consensus estimate by $100 million. On the bottom-line, adj. EPS of -$0.95 trumped the analysts’ call by $0.06.

Looking ahead, Micron expects F2Q revenue of $5.30 billion ± $200 million, some distance above consensus at $5.05 billion. Additionally, the company is forecasting a gross margin of 13% ± 1.5% (vs. 4% consensus), and adj. EPS of ($0.28) ± $0.07, also better than the Street at ($0.61). With a record industry TAM (total addressable market) predicted for calendar 2025, management said it expects business fundamentals will get better throughout 2024.

While investors reacted positively to these results, not everyone is ready to change their stance. Morgan Stanley analyst Joseph Moore, despite acknowledging the positive aspects, remains bearish overall.

“This quarter makes us feel better about some of the Micron-specific earnings underperformance of late,” stated the 5-star analyst, “though it does not convince us that we are back at peak earnings in CY25.”

Moore says the stock is expensive but at the same time also notes that so are many others in the space. Nevertheless, despite the improving conditions, Moore sees better opportunities elsewhere. “We are looking to take advantage of prices that the stock market is giving us, and for a muted memory cycle recovery we see much more upside in peers, mostly WDC which has an implied memory valuation of $3-4 bn vs. Micron’s overall market cap of $90 bn+,” he explained.

As such, Moore’s rating on MU stays at Underweight (i.e., Sell), while his $74.75 price target factors in downside of 12.5% for the coming year. (To watch Moore’s track record, click here)

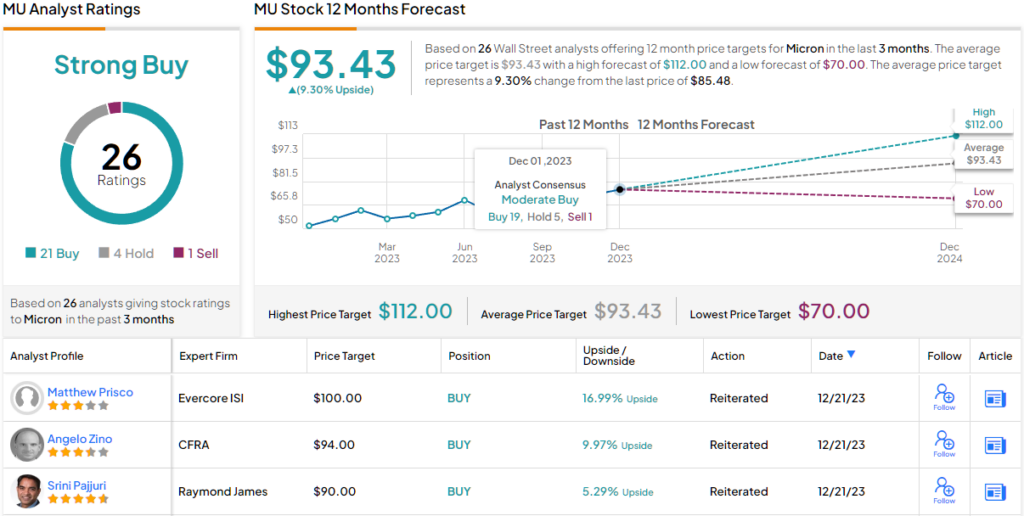

The Morgan Stanley analyst is currently the Street’s lone MU bear. The overall sentiment is decidedly bullish; with the addition of 21 Buys and 4 Holds, the stock claims a Strong Buy consensus rating. Going by the $93.43 average target, a year from now, investors will be pocketing returns of 9%. (See Micron stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.