2024 has been anything but fun for those in the EV space. Stocks across the board have been hit hard and Rivian (NASDAQ:RIVN) has not been spared, either. Despite a recent bounce, the shares are still down by 43% on a year-to-date basis.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Yet, despite the negative sentiment, Rivian has been making strides in the right direction. How so? Well, the company is advancing its second-generation R1 platform, introducing new components and achieving substantial cost reductions, both in materials and manufacturability. For instance, Rivian has slashed the number of in-house ECUs from 17 to 7, and the new quad motor in the second-generation R1 is around 24% cheaper than its predecessor. Moreover, with plans to integrate these improvements into the upcoming R2, the benefits are set to multiply.

Additionally, Rivian’s proposed joint venture with VW could prove pivotal. By leveraging its new electrical/electronic architecture, Rivian expects to strengthen its balance sheet, securing the liquidity needed to navigate the Georgia ramp and move towards positive free cash flow. Rivian also continues to anticipate achieving a modest gross profit in Q4, driven by continued material cost reductions and improved fixed cost leverage.

However, despite all these positives, Goldman Sachs’ Mark Delaney, who ranks in the top 4% of Wall Street stock pros, is not quite willing to get on board here right now.

“We believe the company continues to take steps to improve its earnings potential… However, we maintain our Neutral rating on the stock as we believe EV market demand remains muted, and to the extent Rivian needs to utilize more incentives/pricing action prior to the R2 launch (planned for 1H26), there could be downside risk to EBITDA,” Delaney explained.

Delaney expects RIVN’s share price to stay range-bound in the coming months, given his price target currently stands at $13. (To watch Delaney’s track record, click here)

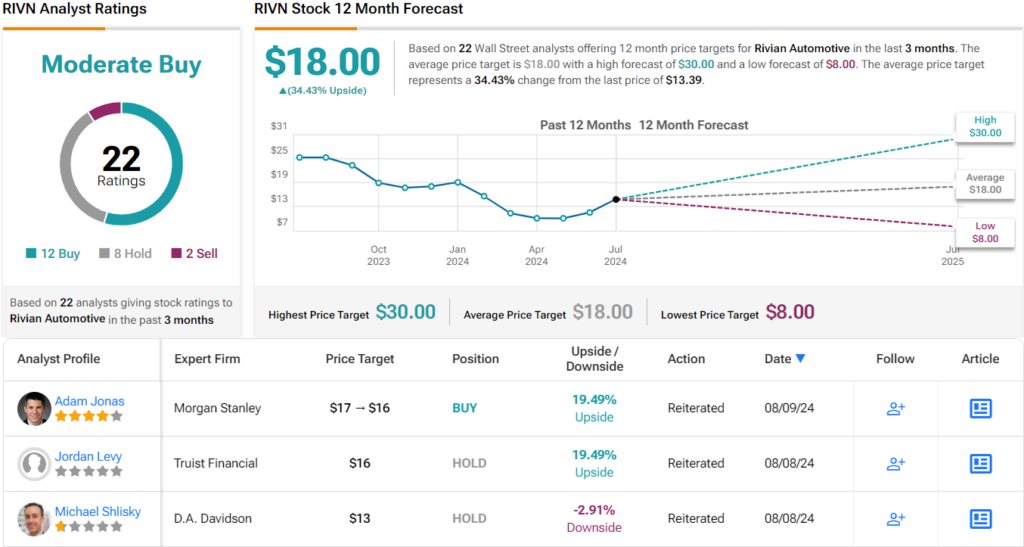

Elsewhere on the Street, RIVN stock garners an additional 12 Buy recommendations, 7 Holds and 2 Sells, for a Moderate Buy consensus rating. The average price target stands at $18, representing a ~34% upside potential from current levels. (See Rivian stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.