A major factor behind Apple (NASDAQ:AAPL) stock’s multiple expansion over the past 5 years – i.e., its valuation has risen faster than its fundamental value – has been down to the growing strength of its Services segment and the attendant improvement in margins.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

During this period, Services has grown from generating 15% of total revenue to 22%, that in turn has helped to boost gross margins. Lately, Apple has employed a new strategy to boost the segment’s growth: by pushing prices higher. The company has significantly increased prices for TV+ (doubling in just 16 months), Music, News, and Apple Arcade since FY2022’s end.

According to Bernstein analyst Toni Sacconaghi’s analysis, Apple’s Services price increases on their own drove services revenue growth by 130 bps year-over-year, and gross and operating profits by $1 billion. For FY24, the analyst reckons that price hikes will give Services revenue an additional 140 bps y/y increase, and boost gross and operating profits by $1.2 billion.

“Notably,” Sacconaghi goes on to say, “Apple has also raised iCloud prices by 25% in several countries; a worldwide rollout of iCloud price increases could be an additional tailwind to revenue growth.”

However, despite the price hikes, Services growth is slowing down. Sacconaghi estimates FY24 revenue growth will reach 11%, the third consecutive year under 15%. For comparison purposes, over the prior 10 years, Apple’s Services CAGR stood at 22%. Over the next 3 – 5 years, Sacconaghi thinks Apple can probably grow services at a low double-digit rate.

“While Apple does command pricing power in many of its Services, we note that the growth of services going forward will continue to largely be dictated by (1) the health of Advertising/Google payments and the App Store, which are 60% of Services revenues; and (2) Apple’s ability to continue to introduce new services offerings,” the analyst explained.

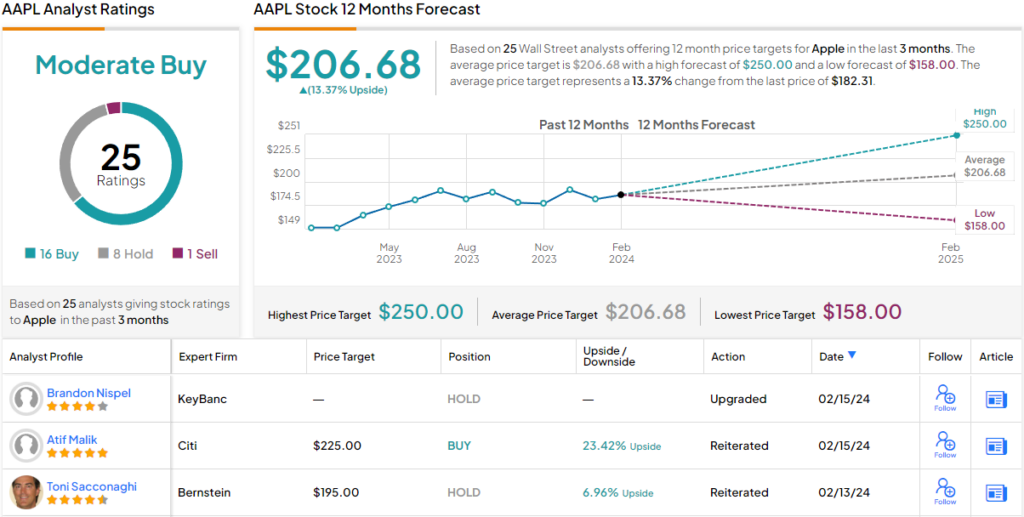

All told, Sacconaghi, sees “near-term risk-reward as neutral,” preferring to stay on the sidelines right now with a Market-Perform (i.e., Neutral) rating and $195 price target. That figure suggests Apple shares have room for growth of 7% from current levels. (To watch Sacconaghi’s track record, click here)

7 other analysts join Sacconaghi on the fence, and with an additional 17 Buys and 1 Sell, the stock receives a Moderate Buy consensus rating. The average price target currently stands at $206.68, implying shares will gain 13% over the coming months. (See Apple stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.