Tesla (NASDAQ:TSLA) may be best known as an electric-vehicle maker, yet it’s often viewed more as a tech play than a pure auto industry player. But would you think the core automotive business should represent just ~12% of its overall value?

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to Bank of America analyst Federico Merendi, that’s exactly the case. His sum-of-the-parts analysis pegs the auto segment at just 12% of Tesla’s valuation, with the bulk attributed to robotaxi (45%), FSD (17%), Energy Generation & Storage (roughly 6%), and Optimus (19%).

Pulling those pieces together, Merendi arrives at a $471 price objective (up from $341), which implies TSLA shares are fairly valued right now. “Our PO revision is driven by a lower cost of equity capital, better Robotaxi progress, and a higher valuation for Optimus to account for the potential entrance into international markets,” the analyst went on to explain.

Along with a new price target, Merendi has updated some estimates to reflect a stronger Energy segment (raising the 2026 margin estimate from 28.5% to 31%). The revision also factors in more affordable Model 3 and Model Y versions, along with the initial contribution of Robotaxi to the Service & Other segment. Additionally, the analyst now expects higher operating expenses of $13.2 billion in 2026, up 24% from his previous estimate, driven by the company’s “growth initiatives.”

Merendi believes Tesla is a “leader in physical AI,’ and he still sees it as having a competitive edge in autonomous driving and physical AI applications in the market right now. “However,” he went on to add, “we acknowledge that there are challenges in the near term and the current valuation is stretched.”

Those near-term challenges include the expiration of IRA incentives, and Merendi expects Tesla to face continued headwinds in the North American Auto segment. This tracks with comments from CEO Elon Musk, who on the Q2 earnings call said the company “probably could have a few rough quarters.”

Still, not everything sits in the caution column. Tesla’s Energy division continues to outperform Merendi’s expectations, and the robotaxi rollout is accelerating. The Austin service footprint has expanded three times already, with plans to enter 8–10 more metro areas by year-end. Merendi believes Tesla’s pure-vision approach gives it an advantage in scaling robotaxi operations faster than rivals.

All in all, Merendi isn’t rushing to pile in. Instead, he urges investors to take a wait-and-see approach and keeps a Neutral rating on the shares. (To watch Merendi’s track record, click here)

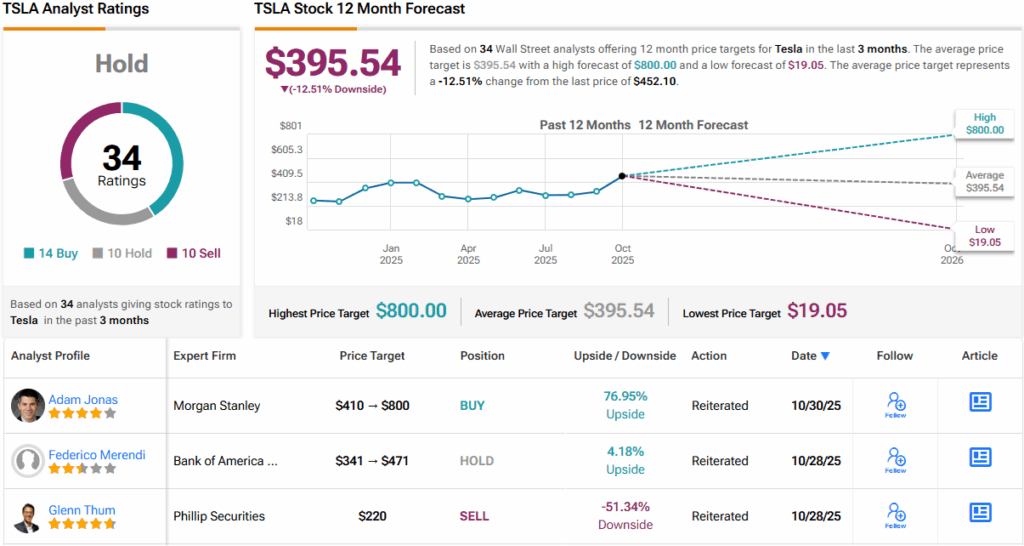

So, that’s Bank of America’s view, but what does the rest of the Street make of TSLA’s prospects? The ratings break down into 14 Buys, 10 Holds, and 10 Sells, resulting in a Hold (i.e., Neutral) consensus. Based on the $395.54 average price target, TSLA shares are expected to change hands at a ~12.5% discount a year from now. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.