Hims & Hers Health (HIMS) stock jumped on Tuesday after the healthcare company announced its expansion into Europe. The company is doing so through its acquisition of digital health platform Zava, which has 1.3 million active customers across the UK, Germany, France, and Ireland.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Hims & Hers Health noted that this will expand the company’s presence in the UK while introducing it to patients in Germany, France, and Ireland for the first time. The company intends to establish its own brand in these countries within the coming quarters through the Zava platform.

The financial details of the deal weren’t revealed, but Hims & Hers Health intends to use cash on hand to fund the acquisition.

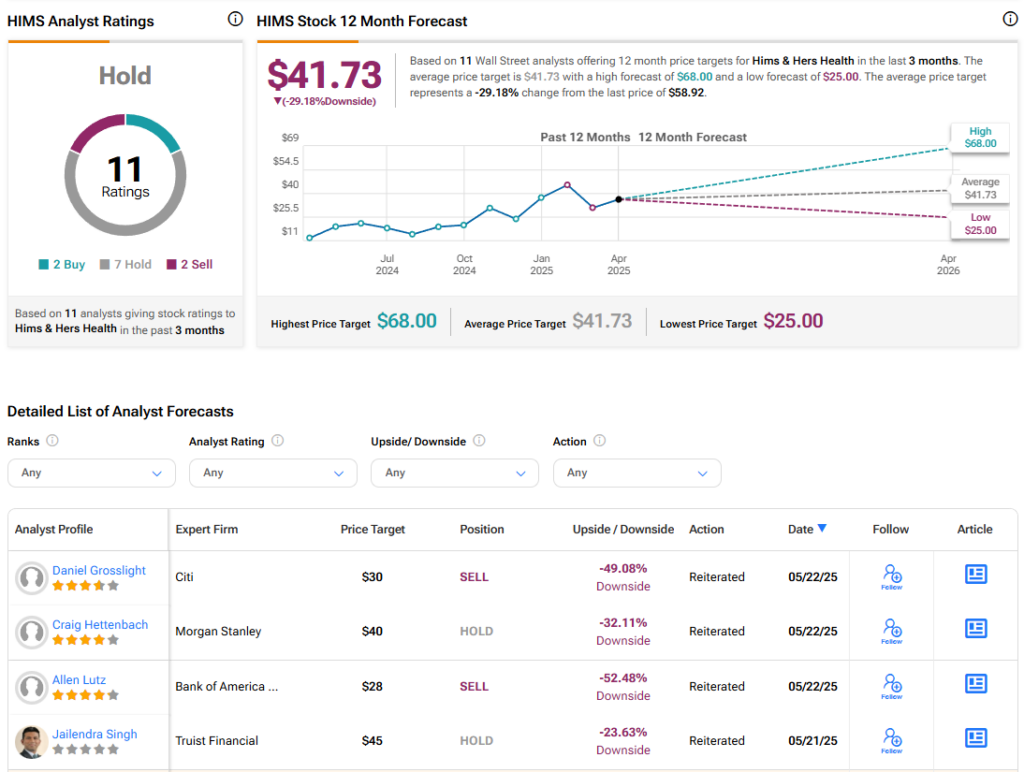

Recent HIMS Stock Analyst Coverage

Four-star Citi analyst Daniel Grosslight reiterated a Sell rating and $30 price target for Hims & Hers Health stock, suggesting a 48.89% downside. The analyst noted that this move accelerates its personalization strategy, but there are still worries about the business, including the cheaper price of weight loss drugs on Zava. He also highlighted the similar offerings available through the two platforms.

HIMS stock was up 3.54% as of Tuesday morning. The stock has also increased 142.97% year-to-date and risen 172.54% over the past 12 months. Today’s rally came with strong trading, as some 35 million shares changed hands, compared to a three-month daily average of 47.9 million shares.

Is Hims & Hers Health Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for Hims & Hers Health is Hold, based on two Buy, seven Hold, and two Sell ratings over the past three months. With that comes an average HIMS stock price target of $41.73, representing a potential 29.18% downside for the shares.