Computing giant Hewlett Packard Inc. (HPQ), which focuses on PCs and printers, said it has secured a 364-day revolving credit facility, with aggregate lending commitments of $1 billion.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Loans under the senior, unsecured revolving credit facility will be used for general corporate purposes, the company said in a SEC filing. JPMorgan Chase Bank, N.A. will act as the administrative agent on the credit line.

Last week, HP reported lower-than-expected revenues with sales sales declining about 11%, while also pulling its financial guidance for the year due to the uncertain business impact of the coronavirus pandemic. The computing giant, which in March already experienced a significant slowdown in some of its products, including printers, as offices closed and trade shows were cancelled, said it expected a larger hit to the print business in the third quarter.

Shares in HP have dropped some 27% so far this year and were trading at $15.14 as of Friday’s close.

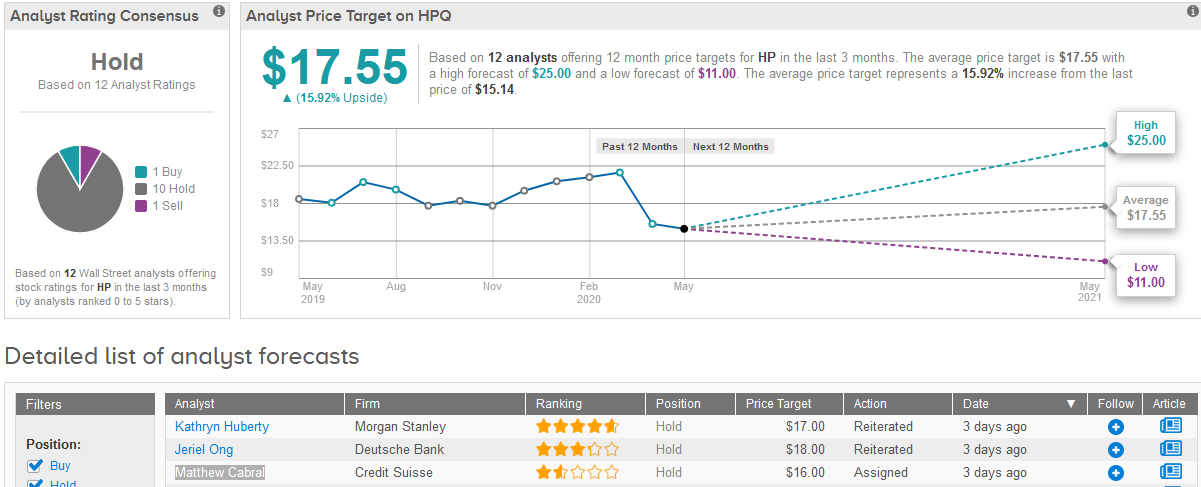

Following last week’s earnings results, Credit Suisse analyst Matthew Cabral cut the stock’s price target to $16 from $17 and maintained a Hold rating.

“We expect the full run-rate of demand weakness to further weigh on F3Q (CSe -25% y/y for Supplies) which, in turn, drags down profitability,” Cabral wrote in a note to investors. “With print under significant pressure near-term and lingering WFH magnifying the secular headwinds coupled with risk of a pull-forward from 2H in PCs, we remain neutral awaiting greater line-of-sight on a return to steady-state EPS/FCF.”

All in all, the Street is currently taking a cautious approach to HP. The Hold consensus rating breaks down into 10 Holds, 1 Sell and 1 Buy. The average price target comes in at $17.55 and implies potential upside of 16%. (See HP’s stock analysis on TipRanks).

Related News:

Logitech Shares Lifted In Pre-Market On Share Buyback Plan, 10% Dividend Boost

Apple Snaps Up AI Startup Inductiv, As Analysts Boost PTs On Store Reopenings

KKR Invests $1.5 Billion in Reliance’s Jio Platforms In Biggest Deal In Asia