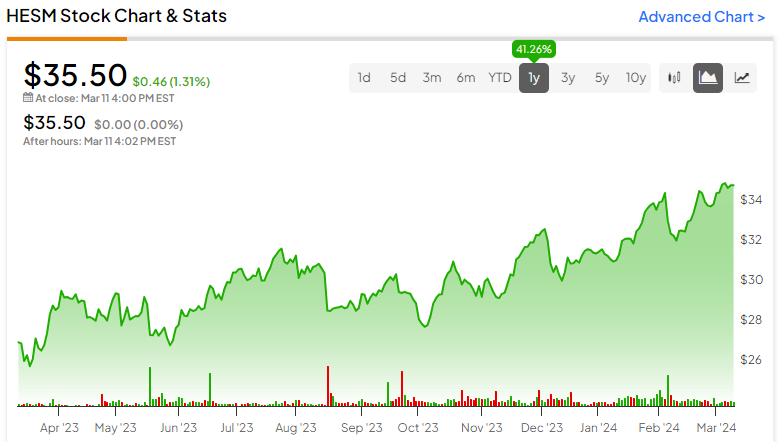

Hess Midstream LP (NYSE:HESM) stands out among midstream energy companies for its predictable revenue generation that is strategically built on contractual commitments, potential for future growth, high dividend yield, and a possible acquisition on the horizon. HESM stock has risen over 41% in the past year but still trades at a reasonable valuation, making it a solid option for consideration by value-oriented income investors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Major Midstream Player

The oil and gas industry utilizes over 2.6 million miles of pipelines to transport oil, natural gas, and liquid gas from upstream production to downstream refining. Midstream companies specialize in gathering, processing, storing, and transporting petroleum products through those pipes.

Hess Midstream is a prominent name in the midstream energy sector. It provides fee-based services to Hess (NYSE:HES), the company from which it was spun off in 2015, and third-party customers.

Hess, a major player in the productive output from the Bakken shale, continues to play an essential role in the growth of Hess Midstream. Contractual commitments between the two extend over several years at a fee structure designed to ensure consistent revenue.

Plus, there is potential optimism on the horizon, as Chevron (NYSE:CVX) might be considering a prospective acquisition following its purchase of Hess, provided that the deal closes successfully.

Recent Financial Results

Hess Midstream posted an overall robust performance for Q4 2023. It reported a Q4 EPS of $0.55, falling slightly short of the consensus of $0.63, and a marginal miss on the anticipated revenue at $356.5 million compared to the consensus of $357.7 million. Nevertheless, the company witnessed an increase in net income to $152.8 million compared to $149.8 million in the same quarter of the previous year.

Hess Midstream also announced an increase in its quarterly cash distribution by 2.7% to $0.63 per Class A share for Q4 2023. The increase aligns with the company’s target of a minimum of 5% annual growth in distributions and puts the dividend yield at a robust 6.96%.

With 2024 predicted to see the first steps of a reversal from previous rate hikes and a declining interest rate environment, high-yielding dividend-paying stocks like Hess Midstream look set to become notably more attractive.

Where the Stock Stands Now

HESM stock has risen over 41% in the last year. At $35.50, it is trading at the top of its 52-week range of $25.63-$35.68. It continues to show positive price momentum, trading above its 20-day (34.16) and 50-day (33.06) moving averages.

With the recent price run-up, the stock trades in fair value territory based on relative metrics such as P/E (16.97x) and P/S ratios (1.5x), which are above the Oil and Gas Midstream industry averages of 11.75x and 1.32x, respectively.

However, the EV/EBITDA ratio of 5.9x is well below the industry average of 9.23x, suggesting that there is still value at current levels.

Is HESM a Buy, Hold, or Sell?

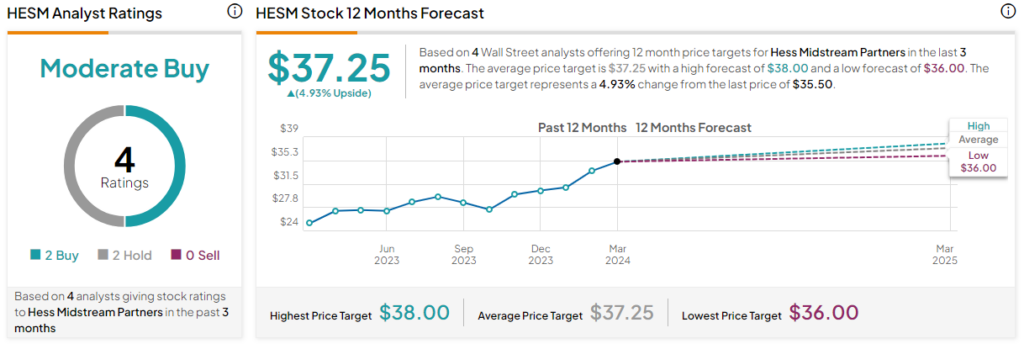

The recent run-up in HESM stock has caused some analysts to revisit expectations. JP Morgan analyst Jeremy Tonet recently downgraded the stock to a Hold from Buy based on the risk/reward profile at current share levels, suggesting the upside potential has mostly been realized at this point.

Hess Midstream stock currently grades out as a Moderate Buy based on an aggregation of four analysts’ stock ratings in the past three months. Their average HESM price target of $37.25 represents an upside potential of about 5% from current levels.

Closing Thoughts

Hess Midstream’s solid financial performance, robust dividend yield, and growth prospects make it an attractive choice in the midstream energy sector. While the recent run-up in its share price has realized much of the stock’s upside, its current EV/EBITDA ratio suggests there is still value to be had. Plus, the possibility of an acquisition gives the stock an option-like kicker. Income investors looking for an investment with upside potential may find this an attractive opportunity.