Shares of Viatris (NASDAQ:VTRS) gained 13% on November 7 after the company announced two acquisitions (Oyster Point Pharma and Famy Life Sciences) to expand its eyecare business concurrent with its Q3 earnings.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Oyster Point Pharma (NASDAQ:OYST) agreed to be acquired by Viatris for $11 per share. The strategic move will make Oyster the backbone of Viatris’ new ophthalmology push, while Famy Life Sciences’ complementary ophthalmology portfolio will further bolster Viatris’ eyecare business.

Based in the U.S., Viatris Inc. is a global healthcare company formed by the merger of generic and specialty pharmaceuticals company Mylan N.V. with Upjohn, Pfizer’s off-patent medicine division, in November 2020.

A Snapshot of Viatris’s Q3-2022 Results

Viatris reported adjusted earnings of $0.87 per share, beating analyst estimates of $0.84 per share. Meanwhile, revenues declined 10% year-over-year to $4.07 billion.

Positively, despite currency and inflationary headwinds, the company reiterated its full-year financial guidance. It continues to expect total revenue to be in the range of $16.2 billion – $16.7 billion.

Is VTRS Stock a Buy?

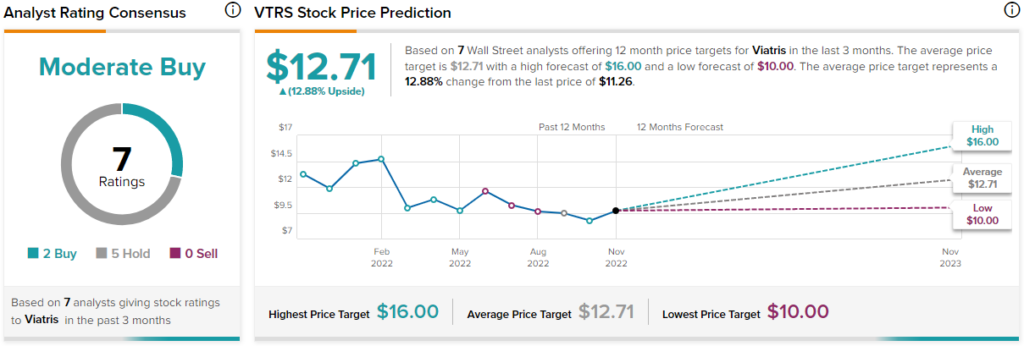

Turning to Wall Street, analysts are cautiously optimistic about Viatris stock and have a Moderate Buy consensus rating, which is based on two Buys and five Holds. Viatris’ average price forecast of $12.71 implies 12.9% upside potential.

Following the news flow yesterday, Piper Sandler analyst David Amsellem upgraded Viatris from Sell to Hold with a price target of $10.

Concluding Thoughts

Viatris stock has lost 18% of its market capitalization over the past year. Importantly, it has regained 29% in just the past 30 days.

Maybe, the worst is behind the company, and the accretive acquisitions will enhance the stock’s potential.