Shares of UnitedHealth Group (UNH) rallied today after its UnitedHealthcare (UHC) insurance division signed a multi-year deal with Memorial Sloan Kettering Cancer Center (MSK) to make the New York cancer hospital an in-network provider for UHC’s health plans. The agreement came right before a June 30 deadline that avoided major disruptions in cancer treatment for thousands of patients in the New York area. UHC’s New York CEO, Junior Harewood, acknowledged how personal and stressful the situation was for families and said that the company was pleased to renew its partnership with MSK.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Without the deal, many MSK services would have become out-of-network starting July 1 for members with UHC commercial plans, which would have led to higher costs or forced patients to switch to different hospitals. However, New York’s 60-day “cooling off” rule would have kept MSK’s hospital services in-network through August 31, but only for people with fully insured plans. That protection didn’t apply to members with self-funded or level-funded plans, which aren’t regulated by state insurance laws. The disagreement also had nothing to do with UnitedHealthcare’s Medicare Advantage coverage.

As for what caused the conflict, both sides pointed fingers at each other. Indeed, MSK urged UHC to return to the table with a proposal that prioritizes patients’ needs and protects access to its cancer care. UHC, on the other hand, said that MSK was asking for nearly a 30% increase in payments for its hospital, facilities, and doctors. UHC stated that its main goal was to reach a deal that keeps access to MSK while also making healthcare affordable for patients and employers.

What Is the Future of UNH Stock?

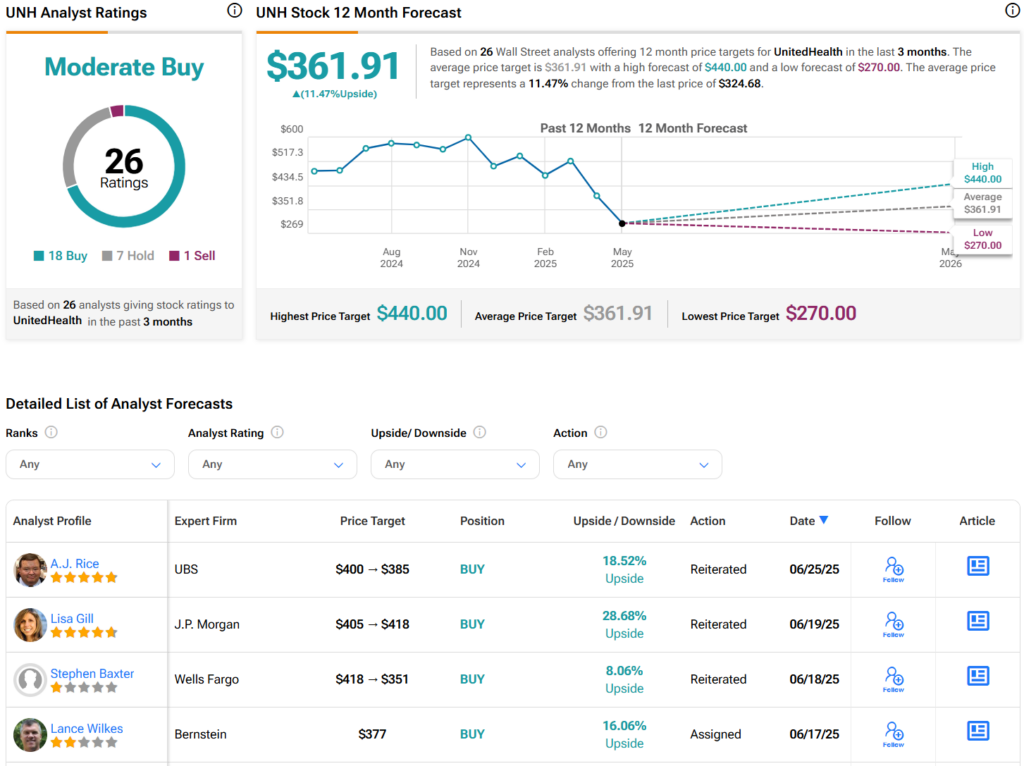

Turning to Wall Street, analysts have a Moderate Buy consensus rating on UNH stock based on 18 Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average UNH price target of $361.91 per share implies 11.5% upside potential.