Turquoise Hill Resources (NYSE:TRQ) (TSE:TRQ) shares gained almost 6% in the extended trading hours yesterday following the news that Rio Tinto (NYSE:RIO) has struck an agreement with certain shareholders who had earlier opposed Rio Tinto’s offer of C$43/share for 49% shares of Turquoise Hill shares.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In a press release, Rio Tinto mentioned that Investment manager Pentwater Capital Management LP, the second largest holder of Turquoise Hill after Rio Tinto and SailingStone Capital, will withhold their votes at the holder meeting to be held next Tuesday, November 8. Both Pentwater and SailingStone agreed to withhold their votes and exercise their dissent rights.

In September, Rio made the offer to acquire 49% of Turquoise Hill shares that it did not already own for C$43 per share. Yesterday, Rio Tinto reiterated that its proposal of C$43 for each Turquoise Hill share is “best and final.”

Per the terms of the agreement, Rio will pay the holders C$34.40 of the consideration following the completion of the deal. The remaining amount will be paid after the final determination of the arbitration.

Earlier, yesterday, Turquoise Hill announced that the Special Meeting scheduled to discuss the acquisition offer by Rio has been postponed until November 8 after Pentwater Capital publicly opposed the deal. Pentwater Capital stated that the deal price undervalued the company’s true valuation.

Is Turquoise Hill Resources a Good Investment?

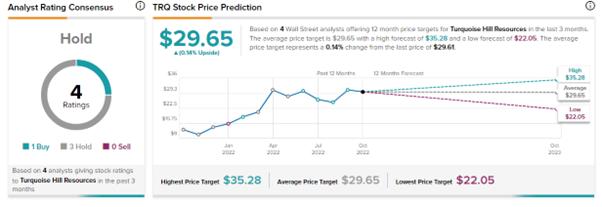

Amid uncertainty on the Rio Tinto deal, Turquoise Hill Resources stock has received one Buy and three Hold recommendations, for a Hold consensus rating. TRQ stock’s average price forecast of $29.65 implies that the shares are fairly valued at current levels.

Read full Disclosure