Teva Pharmaceutical (TEVA) shares gained almost 18% during today’s pre-market trading session after the company delivered impressive second-quarter results while modestly trimming its FY2022 revenue outlook. Investors more than welcomed the company’s announcement of a $4.35 billion proposed nationwide settlement that will reconcile several costly legacy lawsuits over Teva’s alleged role in the U.S. opioid crisis.

Based in Israel, Teva Pharmaceutical Industries is a multinational pharmaceutical company with a current market capitalization of over $9.5 billion.

TEVA’s Q2 Numbers

Adjusted earnings of $0.68 per share easily beat analysts’ expectations of $0.56 per share. The company reported earnings of $0.59 per share for the prior-year period.

Revenues declined 2.6% year-over-year to $3.8 billion but exceeded consensus estimates of $3.78 billion.

TEVA Lowers Revenue Outlook

Based on the ongoing currency headwinds and lowered expected COPAXONE revenues due to increased competition, management lowered revenue guidance for the full-year FY2022 but reiterated earnings expectations.

The company now forecasts FY2022 revenues to be in the range of $15 billion to $15.6 billion (versus the previously guided range of $15.4 billion to $16 billion) and lower than the consensus estimate of $15.57 billion.

However, the company continues to expect adjusted earnings in the range of $2.40 per share to $2.60 per share.

TEVA CEO’s Comments

Teva CEO, Kåre Schultz, commented, “With our strong foundation of generic and OTC business, our focused specialty pipeline and our significant biosimilar pipeline, we are strategically positioned to seize market opportunities and create long term growth.”

Wall Street’s Take on TEVA

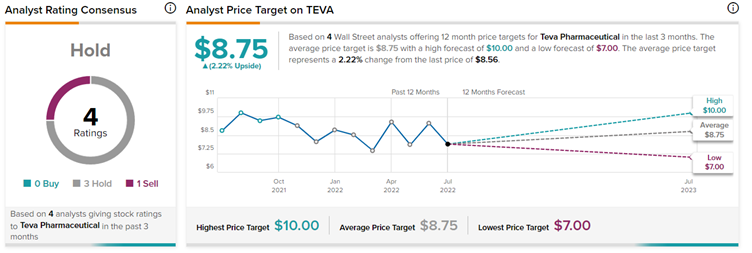

According to TipRanks’ analyst rating consensus, TEVA is a Hold, based on three Holds and one Sell rating. The average TEVA price target is $8.75, implying 2.22% upside potential.

Investors Weigh In on TEVA

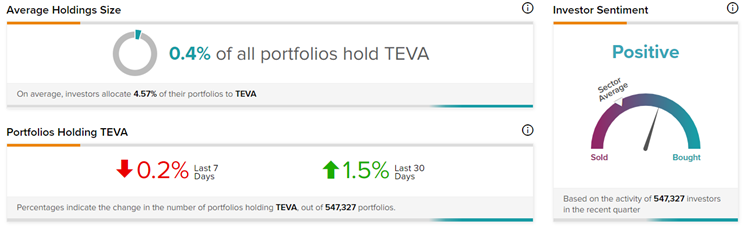

Positively, TipRanks’ Stock Investors tool shows that investors currently have a Positive stance on Teva Pharmaceutical, with 1.5% of investors increasing their exposure to TEVA stock over the past 30 days.

Concluding Thoughts

Shares of Teva have outperformed the underlying benchmark down only 6% over the past year.

Investors cheered the earnings beat despite the ongoing macro challenges as well as the company’s settlement of the opioids litigation.