SoFi Technologies’ (NASDAQ:SOFI) non-bank subsidiary, SoFi Digital Assets, has come under the scrutiny of some federal officers. Four members of the U.S. Senate have expressed their concerns by writing letters to Anthony Noto, CEO of SoFi, and to the representatives of three federal agencies. The letters state that SoFi did not adhere to the terms under which regulators had authorized its conversion to a bank holding company. SoFi stock is down by close to 10% in the past five days, and down 69% YTD.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

They pointed out that, as a compliance measure, the company’s digital asset trading subsidiary, which is required to be divested by January 2024, was urged to refrain from any kind of expansion. However, the senators claimed that since then, new service offerings have been offered.

Also, they worry that SoFi’s balance sheet may not be strong enough to counter any financial downturn, as the capital requirement calculation of digital assets should be in accordance with their risk.

Nevertheless, SoFi has countered these concerns by stating that digital assets are a “non-material component” of its business. The fair value of digital assets held by third-party custodians stood at $132.5 million on September 30, 2022. Further, the company assured being in full compliance with the necessary mandates of the banking license and all applicable laws.

Is SoFi a Good Buy?

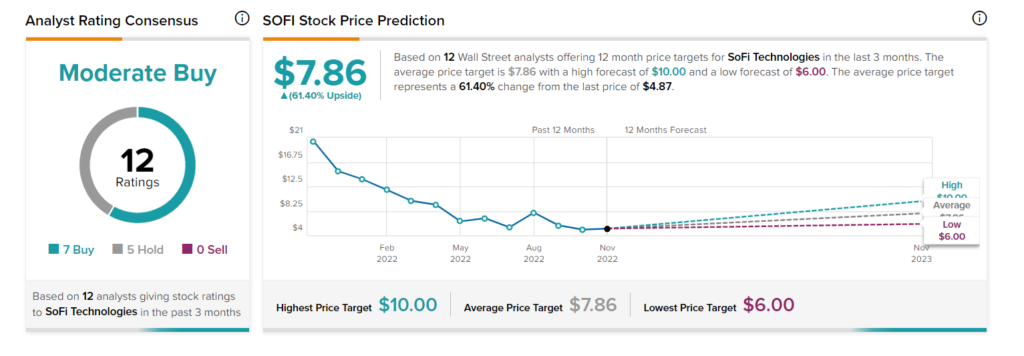

Wall Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on seven Buys and five Holds. The average SOFI stock price target of $7.86 implies upside potential of 61.4%.