Semrush (NYSE:SEMR) announced the acquisition of Traffic Think Tank, a leading marketing education company. Semrush, which provides online visibility management SaaS (Software-as-a-Service) platform, expects its Academy offerings to get a boost from the acquisition. Semrush stock was up about 3.1% in the after-hours of trade.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Semrush Academy is the company’s online learning program, offering multiple courses in different languages.

The Academy is a key growth driver for Semrush. The company leverages the Academy to create brand awareness, improve its existing offerings, engage with the marketing community, and develop new products.

Semrush is strengthening its Academy offerings both organically and through strategic acquisitions. Before the Traffic Think Tank acquisition, Semrush bought Backlinko last year, in January 2022.

Semrush’s Financials

Semrush is set to announce its fourth-quarter financials after the market closes on Monday, March 13, 2023. It continued to acquire new clients and had over 94K paying customers at the end of Q3. While it benefits from a growing customer base, near-term macro headwinds limit customers’ spending capabilities in the short term.

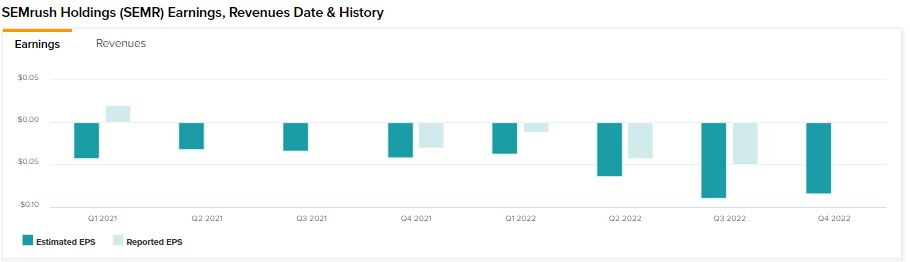

The company has surpassed the Street’s projections in the past four consecutive quarters. However, its loss per share has widened quarter-over-quarter in the current Fiscal year. As for Q4, analysts expect Semrush to report a loss of $0.08 a share compared to a loss of $0.03 in the prior year’s quarter.

Is Semrush Stock a Buy?

Given the ongoing macroeconomic headwinds, analysts are cautiously optimistic about its prospects. Semrush stock has received one Buy and two Hold recommendations for a Moderate Buy consensus rating. Meanwhile, analysts’ average price target of $13.33 implies 50.96% upside potential.