Shares of Radius Global Infrastructure (NASDAQ: RADI), which leases communication infrastructure, jumped over 20% halfway into today’s trading session. This can be attributed to news of a potential takeover from EQT AB.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

However, it’s important to note that no deal has been struck and talks could still end without an agreement. Radius has been entertaining the idea of a potential sale since May.

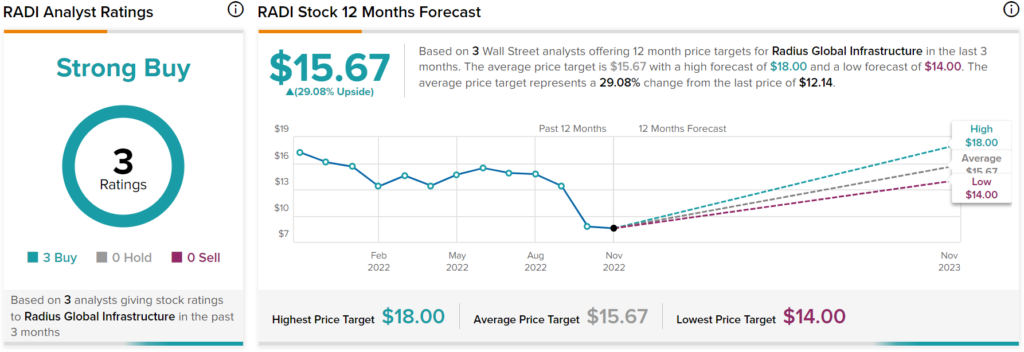

Overall, Wall Street analysts have a consensus price target of $15.67 on RADI stock, implying 29.08% upside potential, as indicated by the graphic above.