Pfizer’s (NYSE:PFE) stock increased more than 5% yesterday after peer-reviewed research demonstrated the weight reduction benefits of the company’s pipeline diabetes drug, danuglipron. Additionally, the study found that PFE’s medication produces outcomes comparable to those of rival Novo Nordisk’s (NVO) Ozempic for diabetes and Wegovy for obesity.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The study was based on Pfizer’s phase 2 clinical trial of danuglipron, released in late 2022. In the trial, 411 adults with type-2 diabetes were given danuglipron twice a day. After 16 weeks, individuals who took the medication at doses of either 120-milligram or 80-milligram had significant weight reduction.

It is important to note that a Phase 3 trial of Novo Nordisk’s Ozempic produced comparable weight reduction but over a period of 30 weeks. This finding might be advantageous for PFE if danuglipron continues to pass clinical trials.

Further, the demand for the medication may be supported by quicker weight reduction. Also, the convenience of danuglipron being an oral medication rather than an injection is a positive.

Is PFE a Good Stock to Buy?

PFE’s strong product pipeline and the $43 billion acquisition of Seagen (SGEN) to strengthen its oncology offerings are encouraging. Importantly, the company has been growing dividends for 12 consecutive years and currently has an impressive dividend yield of 4.28%.

Overall, PFE stock has a Hold consensus rating on TipRanks. This is based on two Buy and nine Hold recommendations. The average price target of $43.27 implies 11.7% upside potential.

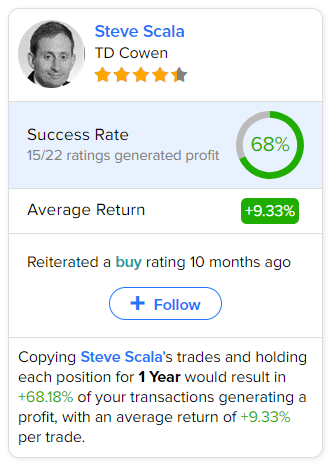

As per TipRanks data, the most accurate and profitable analyst for PFE stock over a one-year time frame is analyst Steve Scala from TD Cowen. Scala has had a 68% success rate in his ratings of the stock, with an average return of 9.33% per trade. Click on the image to learn more.