Shares of BridgeBio Pharma (NASDAQ:BBIO) gained more than 23% in Friday’s extended trade. The upside was due to a Bloomberg report claiming that the company is being eyed for takeover by larger pharmaceutical companies.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

BridgeBio is a commercial-stage biopharmaceutical company engaged in developing treatments for genetic diseases and cancers with clear genetic drivers.

Though long discussions on takeovers are being held, there is a chance that BridgeBio will choose to remain independent in order to profit from upcoming drug trials.

On Thursday, the company announced that it had dosed the first patient with non-small cell lung cancer. This forms part of the Phase 1/2 trial of BBP-398 with Bristol-Myers Squibb’s (BMY) Opdivo (nivolumab) to treat advanced solid tumors with KRAS mutations.

Is BridgeBio Pharma a Buy?

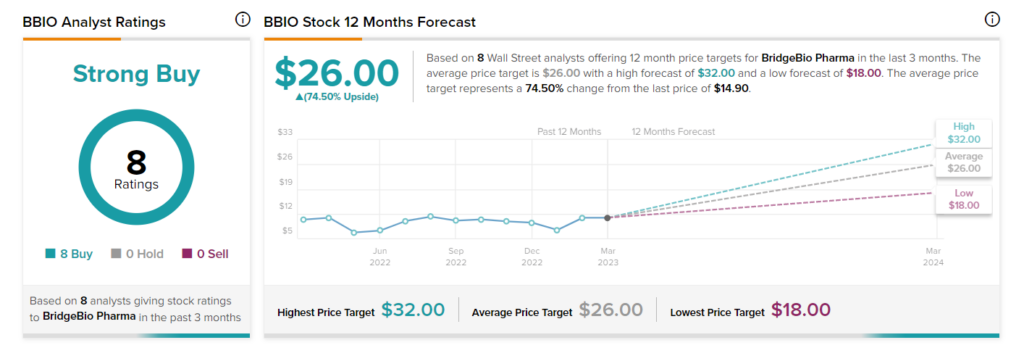

With eight unanimous Buys, BridgeBio commands a Strong Buy consensus rating on TipRanks. Also, the average BBIO stock price target of $26 implies 74.5% upside potential from current levels. Meanwhile, the stock has gained a solid 107.8% so far this year.

On another positive note, BridgeBio has a maximum Smart Score of “Perfect 10” on TipRanks. Note that shares with a “Perfect 10” Smart Score have historically outperformed the S&P 500 Index (SPX) by a wide margin.