Shares of biotechnology company Illumina (NASDAQ:ILMN) hit a fresh 52-week low of $124.40 and ended down 5.6% on October 18, after the news of activist investor Carl Icahn’s lawsuit hit the market. The hedge fund manager sued the gene sequencing company’s ex-CEO Francis DeSouza and the board members, citing failure to uphold their “fiduciary duties” concerning Illumina’s $7.1 billion acquisition of Grail. Year-to-date, ILMN stock has lost 38%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The lawsuit was filed in the Delaware Court of Chancery on October 17 and is closed for public viewing as of now. While announcing the lawsuit at a conference on Tuesday, Icahn said that this was the first time in his very long career that he saw the need “to sue a board of directors in this manner.” Among other things, Icahn blamed the company for draining its finances for the acquisition, hurting its share price due to the ongoing regulatory probes, and doubling DeSouza’s total compensation in 2022.

The billionaire investor has been fighting a long proxy battle with Illumina and is miffed about the company’s decision to complete the acquisition of the cancer drug testing company. In 2021, Illumina acquired Grail without obtaining clearance from European regulators and the U.S. Federal Trade Commission (FTC) for its monopolistic nature. Last week, the European Commission ordered Illumina to sell off Grail. Illumina has decided to divest Grail in 12 months if it does not win its appeal of the court ruling.

Is Illumina a Good Stock to Buy?

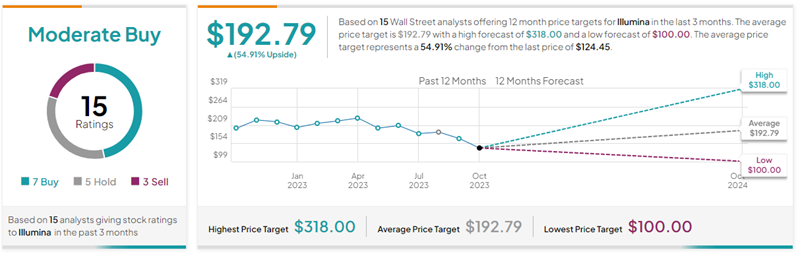

Given the ongoing challenges, Wall Street remains cautiously optimistic about ILMN’s trajectory. With seven Buys, five Holds, and three Sell ratings, Illumina has a Moderate Buy consensus rating on TipRanks. Further, the average Illumina price forecast of $192.79 implies 54.9% upside potential from current levels.