Shares of fashion luxury marketplace Farfetch (NYSE:FTCH) nosedived nearly 37% in extended trading yesterday after reporting mixed second-quarter Fiscal 2023 results. The company’s revenues of $572.09 million fell 1.3% year-over-year and widely missed analysts’ estimates of $648.70 million. Conversely, its adjusted loss of $0.21 per share remained the same as the Q2FY22 number and came in better than analysts’ expected loss of $0.28 per share. What’s worse, Farfetch’s revenue guidance failed to impress shareholders and analysts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Details of Farfetch’s Quarterly Results

Despite the revenue miss, the London-based company certainly had some positive news to share. During Q2, active customers hit 4.1 million, growing 7% year-over-year. Additionally, the Digital Platform division witnessed solid growth in terms of GMV (gross merchandise value), which increased by 6.9% year-over-year. Moreover, Services revenue saw a notable rise of 9.8% compared to the same period in the previous year.

Meanwhile, both GMV and revenue from the Brand Platform segment collapsed by 40.8% and 42.2%, respectively, compared to the prior-year period.

Farfetch’s Outlook for Fiscal 2023

The company’s management is optimistic about its second-half Fiscal 2023 performance. Farfetch is making progress in controlling its cost base and driving towards “strong GMV growth, Adjusted EBITDA profitability, and positive free cash flow.”

Based on these assumptions, Farfetch projects a full-year revenue of $2.5 billion, growing 8.7% annually.

Is Farfetch a Good Stock to Buy?

Wall Street analysts have yet to give their views on Farfetch’s quarterly results. Based on the ratings given before the Q2 print, Farfetch stock has a Moderate Buy consensus rating. This is based on four Buys, four Holds, and one Sell rating received during the past three months. On TipRanks, the average Farfetch price target of $9.57 implies a massive 101.1% upside potential from current levels. Meanwhile, FTCH stock has gained 7.9% so far this year.

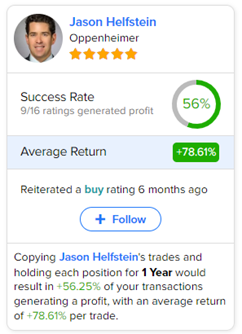

Moreover, investors looking for the most accurate and most profitable analyst for FTCH could follow Jason Helfstein of Oppenheimer. Copying his trades on this stock and holding each position for one year could result in 56% of your transactions generating a profit, with an average return of an impressive 78.61% per trade.