Solar stocks, including Enphase Energy (NASDAQ:ENPH), SolarEdge Technologies (NASDAQ:SEDG), Sunrun (NASDAQ:RUN), and SunPower (NASDAQ:SPWR), rallied over 16%, 10%, 18%, and 15%, respectively, yesterday. The stock price gain can be attributed to a positive U.S. inflation report for October, suggesting a pause in the Federal Reserve’s interest rate hikes.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The U.S. Bureau of Labor Statistics released its data for October’s U.S. Consumer Price Index (CPI) yesterday. The CPI was flat sequentially and rose 3.2% year-over-year, which compared favorably with economists’ expectations of a 0.1% month-over-month and 3.3% year-over-year increase.

Following the release of the CPI data, the yield on 10-year Treasury bonds dropped to 4.45% from 4.6%. These developments signaled a potential slowdown in inflation and sparked expectations of future rate cuts by the Fed.

Wondering why lower rates are important for solar sector businesses? That’s because these companies need to take considerable debt to finance a project, and elevated rates made the cost of borrowing expensive, hitting the bottom line of these solar companies.

Which is the Best Solar Stock Right Now?

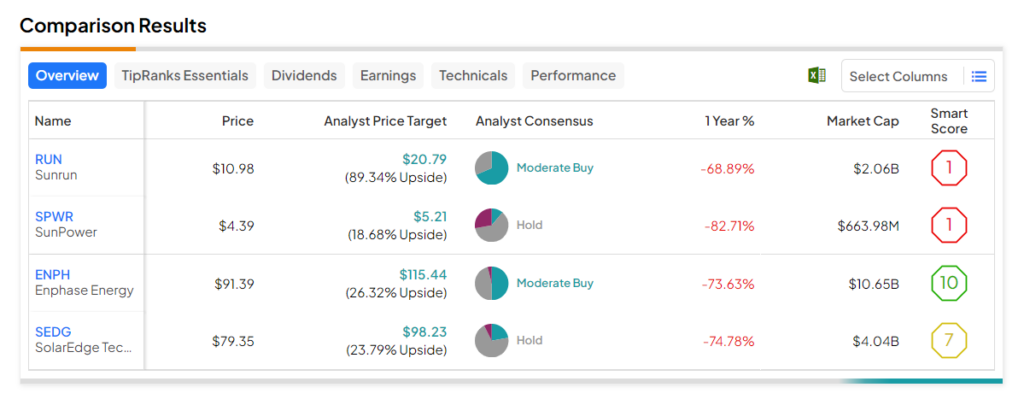

Among the above-mentioned four solar stocks, both ENPH and RUN have a Moderate Buy consensus rating, while SPWR and SEDG have a Hold. Among these stocks, ENPH is the only one with an Outperform Smart Score of “Perfect 10,” which indicates its potential to beat market averages.