enGene Holdings (ENGN) stock is soaring on Tuesday after releasing promising preliminary data from its Phase 2 LEGEND trial for its bladder cancer gene therapy, detalimogene voraplasmid. The news sent ENGN stock up more than 65% in a single session.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The data revealed a 62% complete response (CR) rate at six months in patients with high-risk, BCG-unresponsive non-muscle invasive bladder cancer. This is a major milestone for patients with limited treatment options.

Also, the CR rate at three months was 56%, and all five patients who reached the nine-month mark maintained a CR. The study also demonstrated a favorable safety and tolerability profile, with low rates of treatment-related adverse events.

Importantly, enGene is preparing to submit its therapy for FDA approval in the second half of 2026, a move that could strengthen the company’s position in bladder cancer innovation.

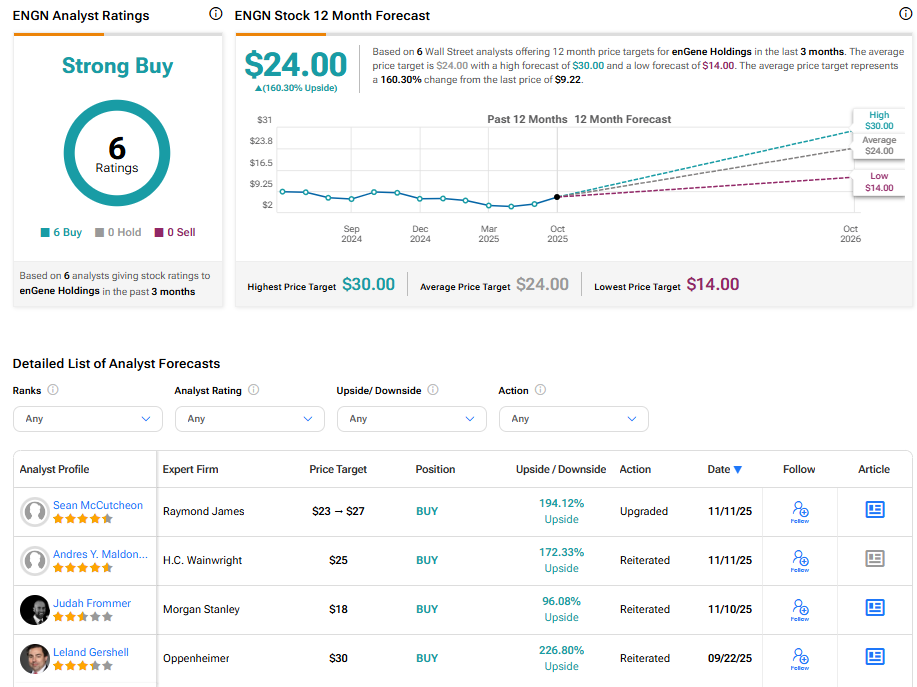

Raymond James Upgrades ENGN Stock Rating

Following the news, Raymond James analyst Sean McCutcheon upgraded enGene stock rating to Buy and raised the price target to $27.

The analyst said the study included more patients than expected, showing strong enrollment and execution. While revenue estimates remain unchanged, McCutcheon sees big potential in treating high-risk bladder cancer, especially in community clinics.

Is ENGN stock a Buy, Sell, or Hold?

Turning to Wall Street, ENGN stock has a Strong Buy consensus rating based on six Buys assigned in the last three months. At $24.00, the average enGene price target implies 160.30% upside potential.