Shares of entertainment giant Endeavor Group Holdings (NYSE:EDR) are surging over 21% in pre-market trading, as of writing, on news of a potential takeover. Private equity firm Silver Lake is mulling acquiring the company and delisting its shares. Silver Lake already owns roughly 71% of voting rights in EDR. Details of the buyout offer remain unknown at the time.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

On October 25, Endeavor released a statement that it is considering a strategic review of its business and assets, which could include a sale or spin-off. The company noted that the businesses represented by its stock remain undervalued at the moment, and the management seeks to unlock its full potential. However, EDR has confirmed that it will not sell its majority stake (51%) in TKO Group (NYSE:TKO). Last month, TKO was formed with the amalgamation of Ultimate Fighting Championship (UFC) and WWE.

On its part, Silver Lake is confident that it does not want to sell any of its shares in EDR to any third party nor sell any of EDR’s assets. Endeavor also owns Hollywood talent agency WME and modeling agency IMG. The global technology investment firm Silver Lake is framing a proposal to take Endeavour private. Year-to-date, EDR stock has lost 16.2%.

Is Endeavour a Good Stock to Buy?

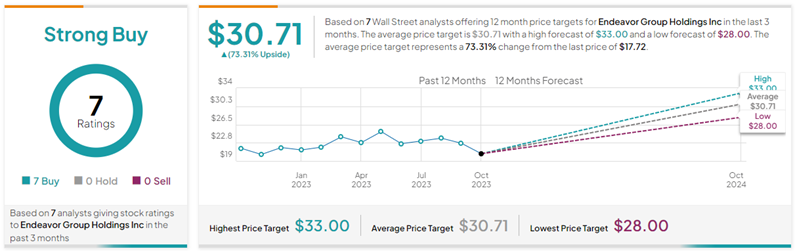

With seven unanimous Buy ratings, Endeavour stock commands a Strong Buy consensus rating on TipRanks. It is important to note that these ratings were given before the news of the strategic review. Analysts could reconsider their views on the stock following the news.

Further, the average Endeavour Group price target of $30.71 implies 73.3% upside potential from current levels.