eBay (NASDAQ:EBAY) shares tanked about 6% in the extended trading hours yesterday after the e-commerce giant reported a 4% year-over-year fall in fourth-quarter revenues to $2.5 billion. The top line, however, surpassed analysts’ expectations of $2.47 billion.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Decline in revenue reflected a 12% fall in Gross Merchandise Volumes to $18.2 billion. The quarterly performance was impacted by lower consumer spending on discretionary products and foreign exchange headwinds.

Meanwhile, adjusted earnings of $1.07 per share increased by 2%, beating the consensus estimate by a penny.

For the full-year 2022, eBay delivered revenues of $9.8 billion, down 6% from last year. Also, adjusted earnings came in at $4.11 per share compared with $4.02 in 2021.

Regarding guidance, the company refrained from providing full-year 2023 outlook due to the uncertain operating environment. Whereas for the first quarter, total revenue is expected to be in the range of $2.46 to $2.50 billion. Further, adjusted EPS is anticipated to land between $1.05 and $1.09.

Capital Deployment Update

Alongside earnings, eBay announced a 14% hike in its quarterly dividend. The new dividend of $0.25 per share is payable on March 24, 2023 to stockholders of record as of March 10, 2023.

The company repurchased $300 million of its common stock in the reported quarter. As of December 31, eBay had more than $2.8 billion remaining in its share repurchase authorization.

Is eBay a Good Stock to Buy?

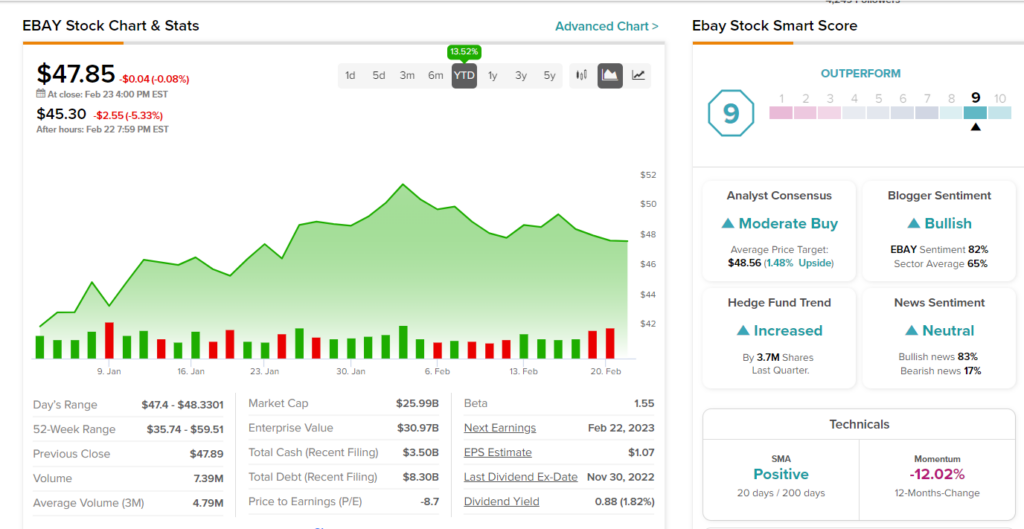

On TipRanks, eBay has a Moderate Buy consensus rating, based on four Buy, six Hold, and one Sell recommendations. The average EBAY stock price target of $48.56 implies 1.5% upside potential. Shares of the company have gained 13.5% year-to-date.

It is worth mentioning that hedge funds have a bullish stance on eBay. Our data shows hedge funds bought 3.7 million shares of eBAY in the last quarter. Also, the stock has a Smart Score of nine, which points to its potential to outperform market averages.