Shares of ContextLogic (NASDAQ:WISH) have gained more than 25% in Thursday’s extended trade and a further 21% at the time of writing. Investors appear enthusiastic about the company’s plan to enhance shareholders’ value.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Recently, the company announced a share buyback program for its Class A common stock worth up to $50 million. The program is set to expire in December 2023.

“We believe that the current macroeconomic environment and the strength of our balance sheet presents an attractive buying opportunity for our stock,” said CFO Vivian Liu.

The share repurchase comes shortly after ContextLogic announced a 1-for-30 reverse split of its common stock. The company undertook the split to comply with the NASDAQ’s minimum $1 per share bid price requirement.

What is the Price Target for Wish Stock?

ContextLogic is currently facing a number of difficulties, such as the post-pandemic slowdown in e-commerce, problems with quality control, and lengthy shipping times. Nevertheless, the company has been working to enhance its prospects by reducing costs, boosting brand recognition, and introducing new features.

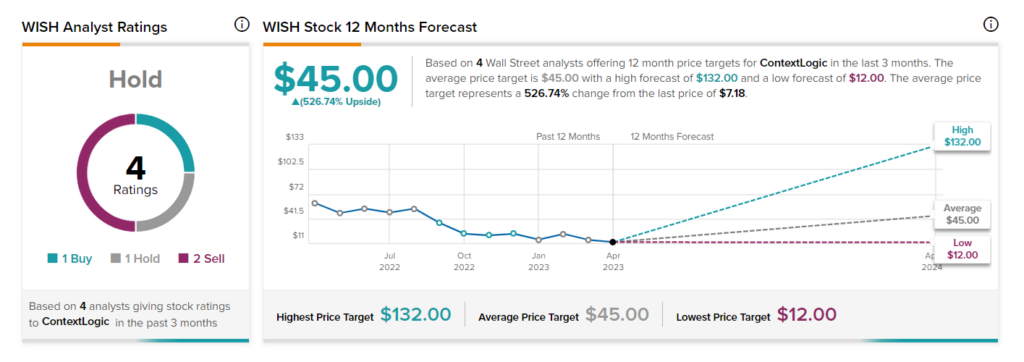

Analysts are currently sidelined on WISH stock with a Hold consensus rating. This is based on one Buy, one Hold, and two Sell recommendations. These analysts’ average price target of $45 reflects a monstrous upside potential of 526.7%.