Coinbase Global (NASDAQ:COIN) stock gained about 6% in the pre-market trading session after the cryptocurrency exchange disclosed that it had bagged a Major Payment Institution (MPI) license from Singapore’s central bank. With this major regulatory approval, the company will be able to expand digital payment token services to both retail and institutional investors in the country.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The MPI license removes the S$3 million transaction limit on any payment service. Also, it allows companies to conduct transactions worth over SG$6 million in a month.

Further, the license will enable Coinbase to make considerable progress in building a presence in Singapore. The crypto exchange has made efforts to develop products and services that cater to the Singaporean market, including features like FAST bank transfers, SingPass onboarding, and no-fee USDC purchases.

Furthermore, COIN has collaborated with major local blockchain firms, including Nansen, Blockdaemon, and Infura, to expand its products like Base blockchain and wallet-as-a-service. Also, the company seeks more deals in the future.

Is COIN a Good Stock to Buy?

Coinbase’s overseas expansion efforts, cost-control measures, and improved financial performance have supported COIN stock’s nearly 123% year-to-date rally. However, the company’s lower trading volume and regulatory woes in the U.S. keep analysts sidelined.

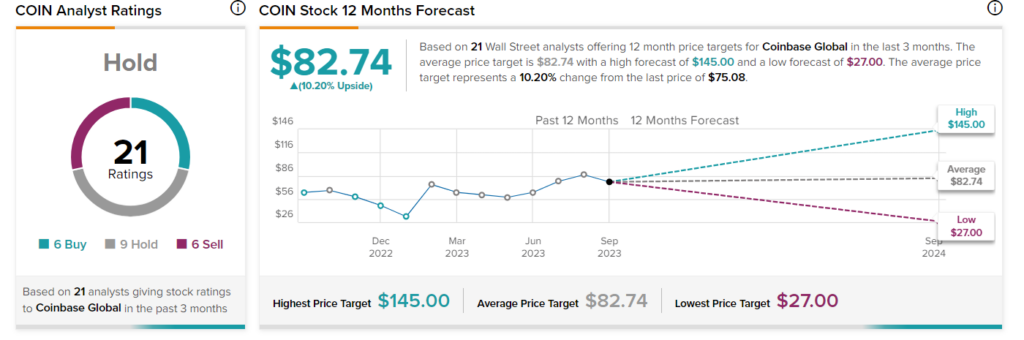

With six Buy, nine Hold, and six Sell recommendations, COIN stock has a Hold consensus rating on TipRanks. Moreover, analysts’ average price target of $82.74 implies a limited upside potential of 10.2% from current levels.