Shares of Chipotle (NYSE:CMG) have been on an overall downtrend since peaking on June 17 at $69.26 per share. This is likely due to several factors, such as its high valuation, peaking same-store sales, and a pause in menu price hikes, according to four-star UBS analyst Dennis Geiger. Investors appear to be growing concerned, as UBS’ crowding score (which tracks fund ownership) for Chipotle fell to its lowest level since November 2023. This indicates that fund managers are becoming less interested in the stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In addition, Jonathan Krinsky, chief market technician at BTIG, pointed out that consumer-related stocks, including restaurants, are facing challenges as inflation and high interest rates affect the economy. Chipotle’s shares, which are trading at 46 times expected earnings, are significantly higher than the average for consumer discretionary stocks and restaurants in the S&P 500.

However, analysts aren’t sounding the alarm to sell CMG just yet. Indeed, Raymond James analyst Brian Vaccaro noted that investors continue to favor high-growth restaurant stocks like Chipotle, which has strong margins and high returns on new stores. Furthermore, from a historical perspective, Chipotle’s valuation has ranged from 25 to 50 times forward earnings and reached a high of 70 times in 2021. This means that its current valuation is not out of character.

In addition, Vaccaro noted that the market’s sentiment may not shift away from high-growth stocks into value stocks until a clear catalyst emerges to do so.

Is CMG Stock a Buy?

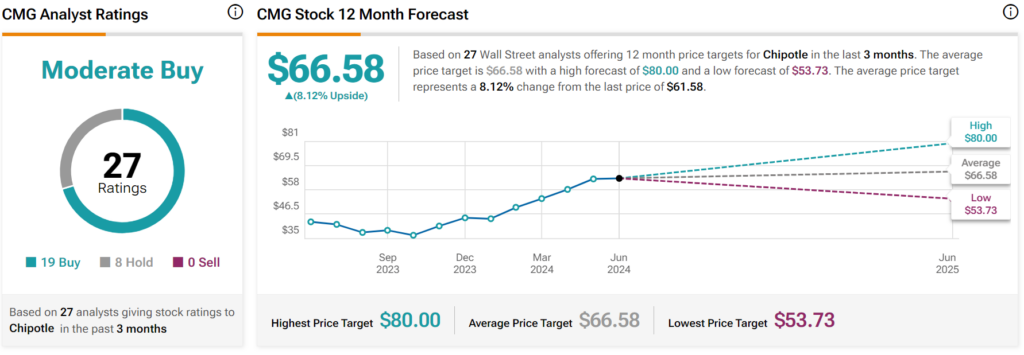

Overall, Wall Street analysts have a Moderate Buy consensus rating on CMG stock based on 19 Buys, eight Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 45% rally in its share price over the past year, the average CMG price target of $66.58 per share implies 8.12% upside potential.