Shares of work management software provider Asana (NYSE:ASAN) are down nearly 15% in the pre-market session today despite the company delivering a better-than-expected third-quarter performance. Additionally, Wall Street’s reaction to the results has been mixed.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Asana’s Q3 revenue increased by 17.8% to $166.5 million, and net loss per share of $0.04 outpaced estimates by a wide margin of $0.07. Further, the number of customers spending $100,000 or more on an annualized basis increased by 18%, and the overall dollar-based net retention rate remained above 100%.

The company ended the quarter with more than three million paid seats and expects revenue for Fiscal Year 2024 to rise by 19%. Importantly, its net loss in Q3 narrowed to $61.8 million from $100.9 million in the year-ago period.

To be fair, this was an impressive performance. Still, the company is witnessing an impact from continued macroeconomic challenges while deal cycles remain stretched. These headwinds are also impacting Asana’s dollar-based net retention rates.

Is ASAN Stock a Good Buy?

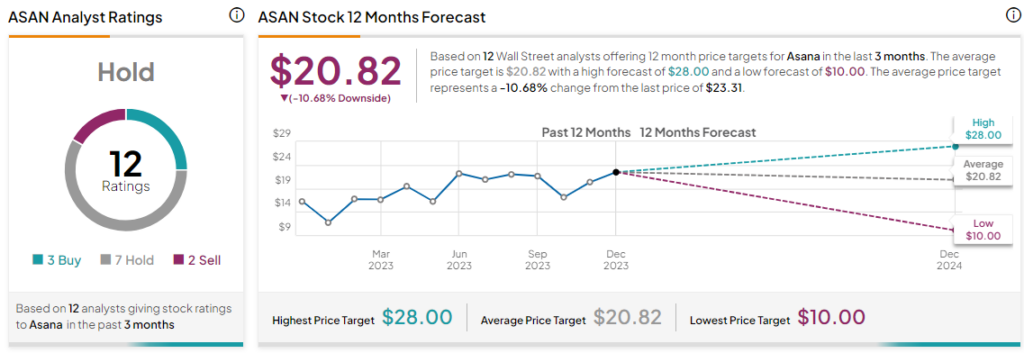

The company expects dollar-based net retention rates to bottom out in the first quarter. It is also focusing on optimizing costs and improving efficiency. While HSBC’s Stephen Bersey believes Asana is moving closer to break-even, the analyst has reiterated a Sell rating on the stock with an $18 price target.

However, JMP Securities’ Patrick Walravens has maintained a Buy rating on Asana with a $27 price target. The analyst views Asana favorably due to its positioning in the expanding work management market, improving cost structure, and a steady dollar-based net retention rate.

Overall, the Street has a Hold consensus rating on Asana. Following a nearly 15% rise in the company’s share price over the past month, the average ASAN price target of $20.82 implies a 10.7% potential downside in the stock.

Read full Disclosure