Armata Pharmaceuticals (ARMP) stock exploded nearly 300% on Wednesday after the biotech firm released encouraging mid-stage trial data for its experimental antibacterial therapy, AP-SA02. The treatment targets Staphylococcus aureus bacteremia, an aggressive and often antibiotic-resistant bloodstream infection.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The results came from Armata’s Phase 2a diSArm study, presented at a medical conference this week. The 42-patient trial, funded by a $26.2 million grant from the U.S. Department of Defense, tested the therapy alongside the best available antibiotic therapy (BAT) versus BAT alone.

Importantly, the company reported that 88% of patients who received its drug showed improvement by Day 12, compared to 58% in the placebo group. The treatment caused no serious side effects, though 6% of patients on the drug had mild issues, while none were reported in the placebo group.

Armata’s Road Ahead

Buoyed by the promising data, Armata revealed plans to launch a pivotal Phase 3 trial in 2026, pending FDA feedback. CEO Deborah Birx called the results “another significant achievement” in the company’s mission to address antibiotic-resistant infections.

The company’s proprietary phage technology is designed to fight bacteria that no longer respond to traditional antibiotics. With growing concerns over superbugs and limited treatment options, Armata’s approach is gaining increased interest from retail and institutional investors.

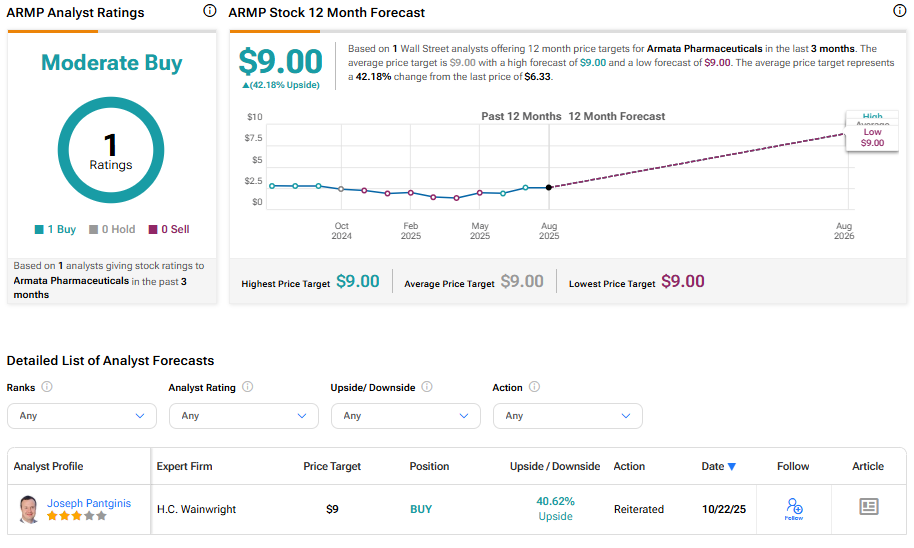

H.C. Wainwright Analyst Sees 29% Further Upside

Following the news, H.C. Wainwright analyst Joseph Pantginis reiterated a Buy rating on ARMP stock with a $9 price target, implying 29.12% upside potential.

The analyst said the lab results and broader trial data strongly support moving AP-SA02 into a Phase 3 trial planned for 2026.