Shares of Applied Materials (NASDAQ:AMAT) are slightly down in after-hours trading. This can be attributed to new export regulations that the company says will impact its financial results. Therefore, management has lowered its outlook for the current quarter.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The U.S. wants to limit China’s ability to obtain important chips required for supercomputers in order to prevent China from developing advanced military capabilities.

As a result, Applied Materials is now aiming for revenue and midpoint earnings per share of around $6.4 billion and $1.66, respectively. This compares to its initial guidance of $6.65 billion in revenue and midpoint EPS of $2.

Is AMAT Stock a Buy or Sell?

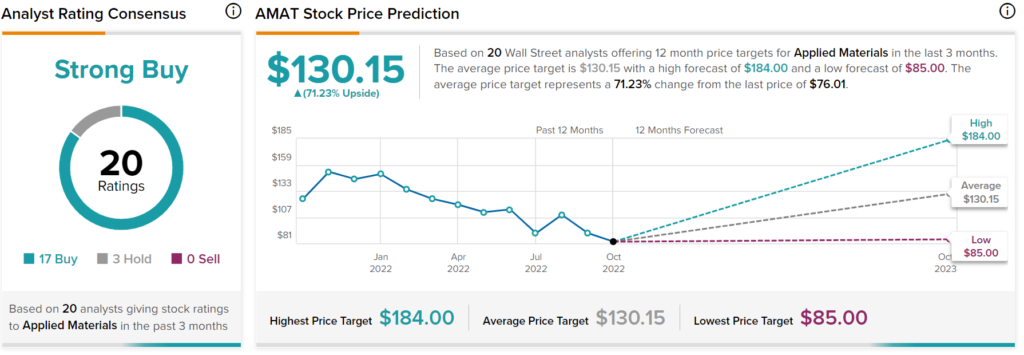

AMAT has a Strong Buy consensus rating based on 17 Buys, three Holds, and zero Sells assigned in the past three months. The average AMAT stock price target of $130.15 implies 71.2% upside potential.