Agrify (NASDAQ:AGFY) shares dived almost 40% on November 9 following dismal Q3 results as well as a cut in the outlook announced by the company.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Based in the U.S., Agrify is the leading provider of innovative cultivation and extraction solutions for the cannabis industry.

A Snapshot of Agrify’s Q3-2022 Results

The Q3 loss of $17.33 per share significantly lagged analysts’ estimated loss of $0.36 per share. Further, it was much worse compared to a loss of $4.68 per share in the prior-year period.

Meanwhile, revenues declined 55.4% year-over-year to $7.02 million and also massively lagged consensus estimates of $20.45 million. The decrease reflected a deferral of design and build revenue of $5.3 million in connection with Bud and Mary’s lawsuit.

Bud & Mary’s Cultivation, Inc., is one of Agrify’s customers. Agrify claimed that Bud and Mary’s Cultivation defaulted on a construction loan facility provided by Agrify in connection with an Agrify Total Turn-Key Solution. The lawsuit was filed by Bud & Mary’s in response to the default notice sent by Agrify.

Agrify’s CEO Raymond Chang commented, “Our third quarter revenue excludes $5.3 million of design and build revenue, which was deferred as a result of a default by Bud & Mary’s ownership on the terms of its Total Turn-Key Solution and Loan Agreements, as well as the current pending lawsuit, and approximately $1.8 million of customer orders that were not fulfilled during the quarter as we managed to the strict quarterly cash spend limits incorporated into our restructured credit facility.”

Based on the ongoing industry headwinds and the impact of the pending lawsuit from Bud & Mary’s, management reduced the guidance range for the full year 2022.

For FY22, total revenue is now expected to range between $65 – $70 million, lower than the prior guided range of $70 – $75 million.

Is AGFY a Buy?

As per TipRanks, analysts are cautiously optimistic about the Agrify stock and have a Moderate Buy consensus rating, which is based on one Buy and one Hold. Agrify’s average price forecast of $2.88 implies 228.47% upside potential.

Concluding Thoughts

AGFY stock has lost 99% of its market capitalization over the past year. Notably, it is trading far below than its all-time high of $320 levels seen in 2021.

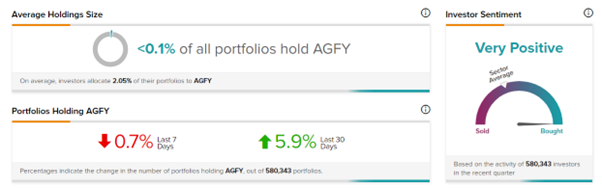

Contrary to the downward spiral movement of the stock over the past month, TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Agrify, with 5.9% of investors on TipRanks increasing their exposure to AGFY stock over the past 30 days.

Read full Disclosure