Plug Power (NASDAQ:PLUG) stock surged over 13% during Monday’s trading session. This increase can be attributed to the positive revenue projections disclosed by the company ahead of its Analyst Day, scheduled for June 14, 2023. In the announcement, PLUG shared its ambitious goal of achieving $20 billion in annual sales by 2030.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Moreover, CEO Andy Marsh reiterated the company’s guidance for full-year 2023 revenues, estimating them to be around $1.4 billion. This anticipated figure surpasses analysts’ expectations of $1.29 billion and reflects a 100% increase from revenues of $700 million reported in 2022.

Furthermore, the Analyst Day event will take place at Plug Power’s gigafactory located in Rochester, New York. This is a significant occasion, as it marks the first time the company has allowed visitors since October 2022. The event aims to showcase the expanded operations at the factory and offer insights into various growth prospects within the Applications and Energy business units. Attendees can expect to receive detailed information about these opportunities during the event.

Marsh said, “We are delighted to welcome our invited guests to our state-of-the-art gigafactory, where they can witness firsthand that we are not only selling and deploying tangible products but have also scaled up operations.”

Is PLUG a Good Stock to Buy?

Plug Power continues to prioritize its growth and development within the hydrogen fuel cell industry. Further, the company’s recent accomplishment of securing three major deals in Europe last month is encouraging. Additionally, Plug Power’s investments in expanding its manufacturing processes serve as a positive indication of its commitment to scaling up operations and further establishing its presence in the market.

Overall, PLUG stock has a Moderate Buy consensus rating based on nine Buys and seven Holds. The average price target of $18.54 suggests 78.8% upside potential from the current levels. Shares have declined nearly 15% year-to-date.

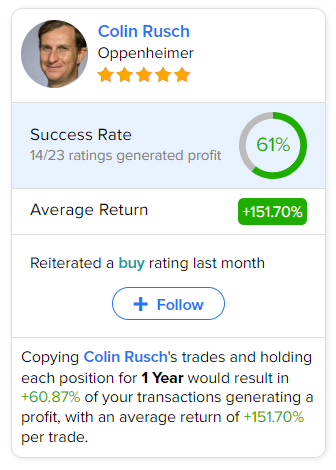

Investors looking for the most accurate and profitable analyst for PLUG could follow Oppenheimer analyst Colin Rusch. Copying the analyst’s trades on this stock and holding each position for one year could result in 61% of your transactions generating a profit, with an average return of 151.7% per trade.