Celsius Network LLC, the cryptocurrency bank that filed for bankruptcy in July 2022, is undergoing stringent scrutiny to understand what went wrong. An independent court-appointed examiner, Shoba Pillay, has pointed out the root cause for Celsius’ collapse.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As per Pillay, Celsius failed to establish appropriate procedures to distinguish between its custodial accounts and funds that could be used for revenue-generating investments.

For the reader’s reference, Celsius operated three different types of accounts. The first and most lucrative was the “earn/interest-bearing accounts,” which gave high-yielding returns on the customer’s digital coin deposits. The second was the “custody accounts.” Celsius signed an agreement with customers that it would not transfer or use funds from custody accounts for investment purposes. Similarly, the third was the “withhold accounts,” created to protect customers from the risk associated with the earn accounts.

Despite the differentiation, Pillay noted that Celsius lacked proper internal controls to maintain the distinction between the account types. Eventually, the funds from the withhold and custody accounts were used for income-generating activities. The point of contention in the investigation remains that customers are unable to figure out which assets belong to them. Also, customers from the custody and withholding accounts insist that their money be returned before the other account holders.

As of the date of the bankruptcy filing, Celsius is said to hold $180 million of coins in custody accounts and just $13 million in withholding accounts. At the time, Celsius had a total of $4.7 billion in coin deposits across accounts, Pillay noted. The next hearing date for Celsius’ case is set for December 5, when the court plans to hold advance discussions on the firm’s custody and withhold accounts.

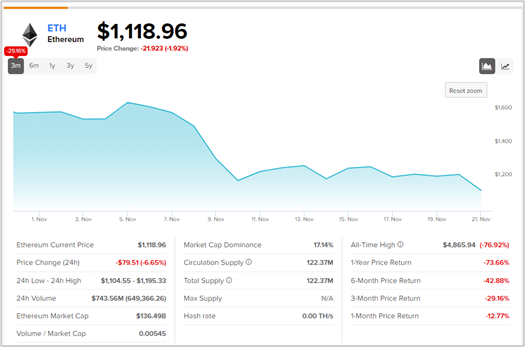

The crypto rout, which started early this year, has led to the collapse of big firms, including Celsius and FTX’s bankruptcy filings. Amid the mayhem, dominant cryptocurrencies like Bitcoin (BTC-USD) and Ethereum (ETH-USD), have lost over 70% in the past year. Importantly, in November alone, Ethereum plunged over 29%.