Jeffrey Smith-led Starboard Value LP disclosed its portfolio position as of September 30, 2022, in a regulatory filing yesterday. This hedge fund, which manages around $5.50 billion in assets, took a new position in Israel-based Wix.com Ltd. (NASDAQ:WIX). The fund also took new positions in a few other Special Purpose Acquisition Companies (SPACs), namely Monterey Capital Acquisition Corp. (NASDAQ:MCAC) and Acri Capital Acquisition Corp. (NASDAQ:ACAC).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

On the other hand, Starboard Value closed positions in Elanco Animal Health (NYSE:ELAN) and department store chain Kohl’s (NYSE:KSS), among others. Let’s take a look at three of the stocks that Starboard Value traded in during the September quarter.

Wix.com Ltd. (NASDAQ:WIX)

Wix.com Ltd. is a software company that provides web development, design, and management solutions and applications. Last week, Wix reported robust Q3FY22 results on the heels of solid demand for its offerings. Notably, WIX stock has gained 30.4% in the past six months. No wonder Starboard took a $2.57 million stake in the company.

In the quarter, Wix’s revenue jumped 8% year-over-year to $345.80 million. Further, adjusted earnings came in at $0.06 per share, while the company reported an adjusted loss of $0.21 per share in Q3FY21.

Is WIX a Good Stock to Buy?

Wall Street analysts have mixed opinions on WIX stock. On TipRanks, the stock has a Moderate Buy consensus rating. This is based on nine Buys, four Holds, and one Sell rating. Also, the average Wix.com price target of $98.14 implies 12.9% upside potential to current levels.

Elanco Animal Health (NYSE:ELAN)

Elanco Animal Health is an American pharmaceutical company that produces medicines and vaccinations for pets and livestock. In its Q3FY22 results, Elanco reported an adjusted profit of $0.20 per share, mostly in line with the prior-year quarter figure of $0.19 per share.

However, total revenue fell 9% year-over-year to $1.03 billion owing to a global economic slowdown. Moreover, the company reduced its full-year Fiscal 2022 revenue and adjusted earnings guidance. ELAN stock has lost 44.7% in the past six months.

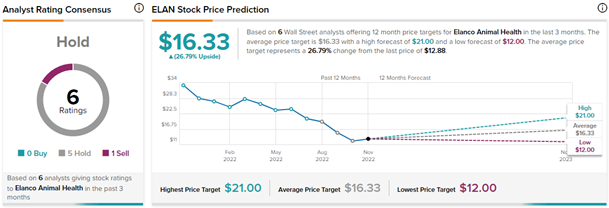

Is Elanco Stock a Good Buy?

Going by the company’s latest results, now may not be a good time to buy ELAN stock. On TipRanks, the stock has a Hold consensus rating based on five Holds and one Sell. The average Elanco Animal Health stock prediction of $16.33 implies 26.8% upside potential to current levels.

Kohl’s (NYSE:KSS)

Kohl’s department stores offer exclusive brand apparel, shoes, accessories, and home and beauty products. The retailer has taken a huge hit from the unfavorable macroeconomic headwinds. In the past six months, KSS stock has lost 34.1%.

Recently, the retailer announced preliminary third-quarter results that beat expectations and the departure of its CEO Michelle Gass. Kohl’s is pursued by activist investor Macellum Advisors to bring board changes, improve financial performance, and boost the stock price.

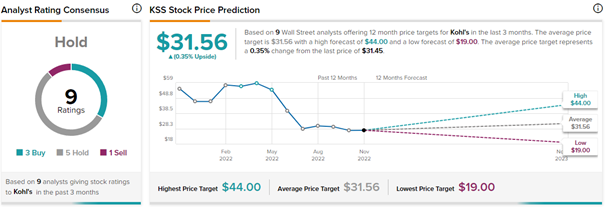

Is Kohl’s a Buy or Sell?

On TipRanks, Kohl’s stock has a Hold consensus rating. This is based on three Buys, five Holds, and one Sell rating. The average Kohl’s target price forecast of $31.56 implies that shares are fairly valued at current levels.

Ending Thoughts

Starboard Value’s portfolio has displayed a dismal performance in 2022, though the fund has gained 27.4% since 2013. As per the latest 13-F filing, Starboard Value’s portfolio value decreased to $4.55 billion at the end of Q3 from $5.50 billion at Q2-end, which had decreased from over $7.5 billion in Q1.

Also, Smith currently has a two-star rating on TipRanks, and a Sharpe ratio of 0.33, which means that his picks have not generated adequate returns compared to the risks involved.

Remarkably, more than half of Starboard’s portfolio is concentrated on technology and financial stocks combined, which have been severely impacted by the uncertain macro backdrop. Having said that, Smith has undertaken a prudent portfolio reshuffle in the third quarter, which may prove to be profitable for the fund. Following a hedge fund’s stock recommendations may prove insightful and beneficial to an investor’s portfolio. Find out which stock the biggest hedge fund managers are buying right now.