The federal electric vehicle (EV) tax credit of $7,500 is set to end on September 30. Amid concerns about a decline in EV demand, legacy automakers General Motors (GM) and Ford Motor (F) are attempting to mitigate the impact on customers by launching new programs that will extend the benefit for several more months by keeping EV lease deals attractive despite the end of the EV credit.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

GM, Ford Attempt to Soften the Blow from the End of EV Tax Credit

According to Reuters, GM and Ford have recently launched programs for their retailers, under which the financing arm of these automakers will initiate the purchase of EVs from dealer inventories by covering the down payments.

This move would enable loan providers to qualify for the $7,500 federal tax credit. The dealer will then offer standard lease terms to retail customers, incorporating the $7,500 subsidy into the lease rates. This strategy is designed to combat the impact of the end of the tax credit policy, which has existed for over 15 years to encourage EV adoption.

“We worked with our GM dealers on an extended offer for customers to benefit from the tax credit for leases of EVs,” General Motors confirmed to Reuters. Meanwhile, Ford stated that it was working to offer its EV customers competitive lease payments on retail leases through its Ford Credit unit until December 31.

It is worth noting that GM and Ford’s programs were designed after holding discussions with officials at the Internal Revenue Service (IRS). In August, the IRS clarified that vehicles must be purchased by September 30 to qualify for the $7,500 tax credit. Interestingly, last week, Tesla (TSLA) CEO Elon Musk hit back at critics who have been warning of a collapse in EV demand and the impact on TSLA stock due to the end of the EV tax credit. In a post on X, Musk stated, “A lot of people thought Tesla stock would collapse as the tax credits came to an end this month. Guess not.”

Wall Street’s Ratings on GM, F, and TSLA Stocks

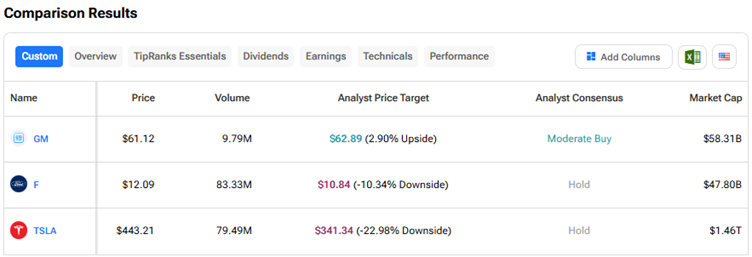

Using TipRanks’ Stock Comparison Tool, let’s look at analysts’ ratings for General Motors, Ford, and Tesla stocks. Amid macro uncertainties, tariff pressures, and intense competition in the EV space, Wall Street has a Moderate Buy consensus rating on General Motors stock, while it has a Hold consensus rating on both Ford and Tesla stocks.

While Wall Street’s average price targets for Ford and Tesla stock indicate downside risks, the average GM stock price target of $62.89 implies 2.9% upside potential. GM stock has advanced about 15% year-to-date, while Ford and Tesla stocks have risen 22% and 10%, respectively, over the same period.