Revenue represents the income generated from sales of products or services and directly impacts a company’s ability to survive and grow. It is a crucial indicator of a business’s ability to compete in the marketplace, reflecting the general financial stability of the company. Thus, TipRanks provides investors with a snapshot of the top five revenue-generating companies, based on the last reported quarter.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

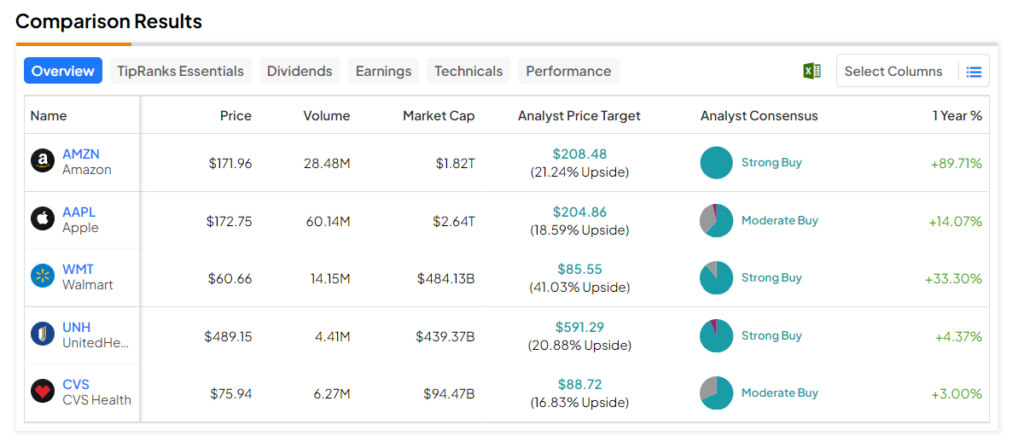

Let’s take a look at the top five U.S. companies by sales volume.

- Walmart (NYSE:WMT): Walmart is the world’s largest retailer, offering a wide range of products and services through its physical stores and e-commerce platform. WMT reported revenues of $173.39 billion in the fourth quarter. The stock has a Strong Buy consensus rating, and the analysts’ average price target implies a 41% upside potential from current levels.

- Amazon (NASDAQ:AMZN): This multinational technology and e-commerce company is known for its online retail platform, cloud computing services, digital streaming, artificial intelligence, and consumer electronics. It generated $169.96 billion in revenues in the latest reported quarter. AMZN stock has a Strong Buy rating and an analyst consensus upside of 21.2%.

- Apple (NASDAQ:AAPL): This multinational technology company is known for designing, manufacturing, and selling consumer electronics, software, and services globally. Apple reported $119.58 billion in revenues in the previous quarter. It has a Moderate Buy consensus rating and the analysts’ average price target on AAPL stock implies an upside potential of 18.6%.

- UnitedHealth (NYSE:UNH): This diversified healthcare company offers health insurance services, healthcare products, and information technology solutions. UNH delivered revenues of $94.43 billion in the last reported quarter. Analysts have a Strong Buy consensus rating on UNH stock and currently see an upside potential of 20.9%.

- CVS Health (NYSE:CVS): CVS operates pharmacies and provides pharmacy benefit management services. The company reported revenues of $93.97 billion in the previous quarter. CVS stock’s average price target implies an upside potential of 16.8% and has a Moderate Buy consensus rating on TipRanks.