There’s no doubt that consumer products giant Procter & Gamble (NYSE:PG) has delivered over the years as a dividend stock par excellence. But there are also some signs of trouble ahead. The latest word about new restructuring costs hit hard and sent shares down over 2% in Tuesday afternoon’s trading session.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The restructuring in question will come with a hefty price tag, reports noted, as Proctor & Gamble plans to shift its operations around, including in several major markets like Nigeria and Argentina. The restructuring—planned to address a series of “…challenging macroeconomic and fiscal conditions”—will cost between $1 billion and $1.5 billion.

But that’s not all; its 2005 acquisition of Gillette will result in a $1.3 billion noncash impairment charge, based on a reduction in the “estimated fair value” of the “…Gillette indefinite-lived intangible asset.” That leads to a total cost—mainly noncash, however—of between $2.3 and $2.8 billion over the next two years. Further, that projection may change if there are more alterations to the Gillette asset.

Berkshire Hathaway Sells PG Stock

If that last part didn’t sound like good news, then you’re not alone. Recently, Berkshire Hathaway (NYSE:BRK.B) revealed that it sold off its entire stake in Procter & Gamble. And, market contrarians—not to mention those with just a little snark in them—will want to know that Jim Cramer, just three weeks ago, announced that it was time to buy Procter & Gamble as the US dollar continued to weaken. Given there’s a fund out there that does everything the opposite of Jim Cramer—the Inverse Cramer Tracker ETF (NYSEARCA:SJIM)—it’s a point worth considering. Though admittedly, SJIM is actually down nearly 10% over the last year.

Is P&G a Buy, Sell, or Hold?

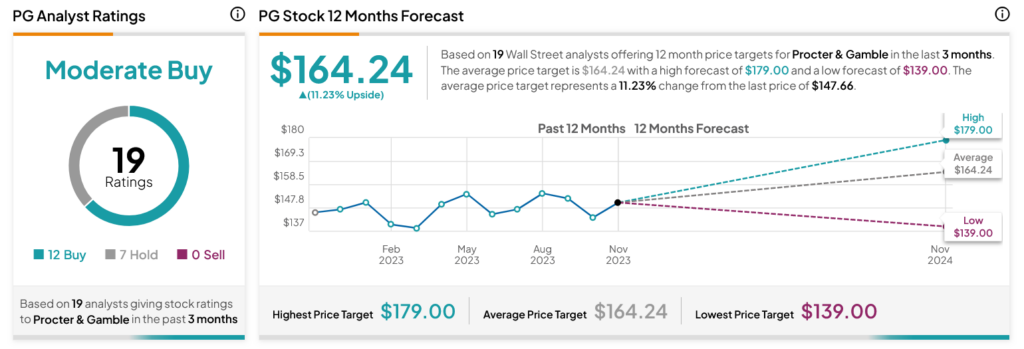

Turning to Wall Street, analysts have a Moderate Buy consensus rating on PG stock based on 12 Buys and seven Holds assigned in the past three months, as indicated by the graphic below. After a 1.63% rally in its share price over the past year, the average PG price target of $164.24 per share implies 11.23% upside potential.