Goldman Sachs’ (GS) Research recommends that investors buy gold and other commodities to hedge against “unexpected risks” in the financial markets. In a new report, the financial firm points out that gold has already risen by 40% this year, and predicts that gold’s price will rise to $4000 by mid-2026. Furthermore, gold ETFs’ holdings grew from 2591.78 tonnes in January 2025 to 2991.93 tonnes in September 2025.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Gold and Commodities Mitigate Tail Risks

Both gold and commodities can help protect portfolios from risks such as inflation and slowing economic growth, particularly in cases of global policy uncertainty and supply shock. When pundits and investors start questioning the capability of central banks and governments to guide the economy, gold rises.

Likewise, when supplies (such as gas, for example) are suddenly limited because governments are using them as political collateral, both commodities and gold tend to rise. As globalization diminishes, commodities become more concentrated, and countries are more likely to use their ownership of particular commodities as leverage on the geopolitical stage. That, in turn, “may reinforce the diversification benefits of commodities in portfolios,” explains the report.

In fact, says Goldman Sachs, historically commodities or gold have shown upbeat performance during any 12-month period since 1970 in which both stocks and bonds delivered negative real returns.

Which Gold ETF Is Best?

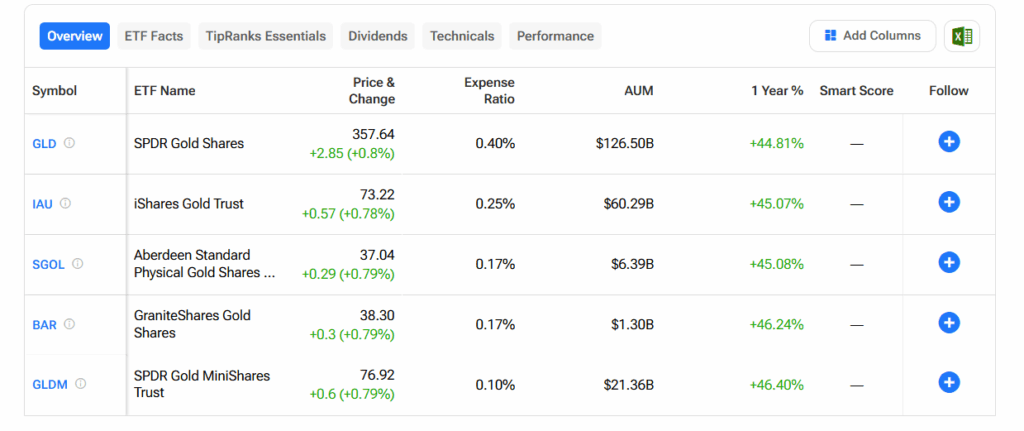

As you can see from TipRanks’ ETF Comparison Chart, gold ETFs have shown outstanding performance this year. The competition is close, but of the gold ETFs shown below, GLDM, the SPDR Gold MiniShares Trust, has increased the most.