Hedge funds have made some major changes to their stock positions as evidenced by their recent Q1 filings. While bank and energy stocks were the top picks for hedge fund manager Michael Burry of Scion Asset Management, activist investor Daniel Loeb from Third Point picked up new stakes in biggies of the tech sector.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Burry picked up new stakes in First Republic Bank of around 150,000 shares, Capital One Financial (NYSE:COF), Huntington Bancshares (HBAN), New York Community Bancorp (NYCB), PacWest Bancorp (PACW), Wells Fargo (WFC), and Western Alliance Bancorp (WAL).

Even Warren Buffett’s Berkshire Hathaway (NYSE:BRK.A) (BRK.B) has bet big on Capital One Financial.

The energy sector proved to be another favorite of Burry as he picked up a share in Coterra Energy (CTRA), Devon Energy (DVN), and precious metals mining company Sibanye Stillwater (SBSW). Burry also disclosed a new position of just over 684,000 shares in online retailer RealReal (REAL) while exiting his stake in SkyWest (SKYW) and MGM Resorts (MGM).

Tech Sector Top Favourite for Daniel Loeb

Daniel Loeb from Third Point picked up new positions in tech biggies including Alphabet (GOOGL) , Alibaba (BABA), Advanced Micro Devices (AMD), Micron Technology (MU), and Salesforce (CRM).

Loeb exited his positions in SentinelOne (S), Fidelity National Information Services (FIS), and The Walt Disney Co. (DIS).

Point72 Founder Steven Cohen Adds New Positions in AT&T and Intel

Hedge fund founder of Point72 Asset Management and the owner of the New York Mets, Steven Cohen, bet big on telecom major AT&T (T), chip majors Intel (INTC) and Nvidia (NVDA), retailing giant Walmart (WMT) and pharma company AbbVie (ABBV) in Q1, according to its SEC filing.

In contrast, Cohen exited his stakes in EV major, Tesla (TSLA), Airbnb (ABNB), Uber Technologies (UBER), and Halliburton (HAL).

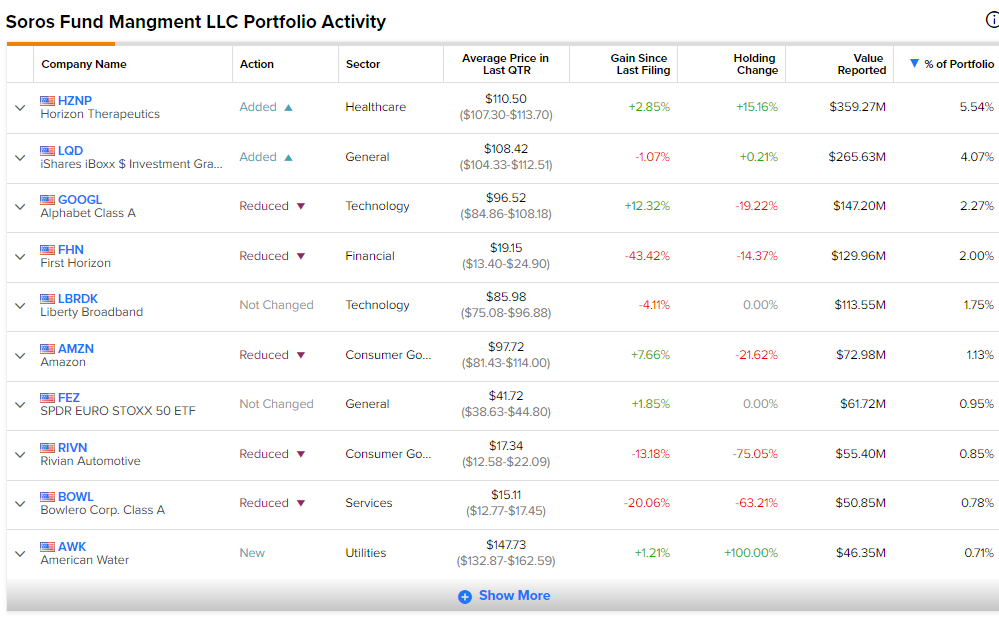

Soros Exits Tesla Completely

George Soros, the billionaire, and founder of Soros Fund Management completely exited his stake in Tesla. The hedge fund had a position of around 130,000 shares in the EV major.

Soros also reduced his stake in the EV company, Rivian (RIVN), and tech giants including Alphabet and Amazon (AMZN).