Harley-Davidson (NYSE:HOG) shares are down in double digits today after the motorcycle company announced third-quarter results. During the quarter, revenue declined by 6.1% year-over-year to $1.55 billion. Still, the figure exceeded estimates by $190 million. Furthermore, EPS of $1.38 outpaced expectations by $0.03.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Amid a difficult macroeconomic and consumer backdrop, HOG introduced two new CVO motorcycles. The drop in sales was attributable to a 9% revenue decline at HDMC (Harley-Davidson Motor Company). This impact was partially offset by 15% revenue growth at HDFS (Harley-Davidson Financial Services).

During the quarter, total motorcycle shipments at HDMC declined by 20% to 45,300, with operating income in the segment nosediving by 37% to $175 million. Moreover, weak macroeconomic conditions resulted in lower Harley-Davidson motorcycle sales across all of its key geographies globally.

Higher interest income drove the double-digit revenue uptick in HDFS, but operating income in the segment dropped by 27% owing to higher provision for credit losses. Looking ahead to Fiscal Year 2023, the company expects revenue growth at HDMC to be flat to 3%, alongside an operating income margin of 13.9% to 14.3%. Operating income at HDFS is anticipated to decline by 20% to 25% for the year.

Is HOG Stock a Good Buy?

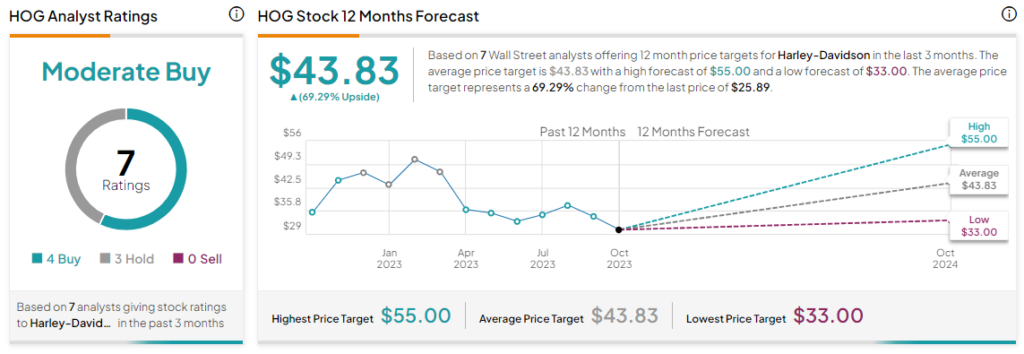

Overall, the Street has a Moderate Buy consensus rating on Harley-Davidson. The average HOG price target of $43.83 implies a 69.3% potential upside. That’s after a mega 37.5% value erosion in HOG shares so far this year.

Read full Disclosure