It has been a dizzying journey for D-Wave (NYSE:QBTS). The quantum computing company has skyrocketed about 1,920% over the past year, fueled by a wave of investor enthusiasm surrounding the quantum revolution. Yet, even with those extraordinary gains, the stock has cooled recently, sliding 34% from its peak over the past three weeks.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Once the euphoria cooled, the market’s focus shifted back to fundamentals. And that’s where the story becomes more grounded. D-Wave’s latest quarterly report revealed meaningful progress in scaling its business but also underscored the company’s ongoing struggle to turn innovation into profit.

For the third quarter, D-Wave reported revenue of $3.7 million, doubling from a year earlier, while bookings climbed to $2.4 million, signaling growing customer adoption. Profitability metrics also improved, with GAAP gross margin expanding to 71.4% and non-GAAP gross margin reaching 77.7%, driven by a stronger mix of cloud services and quantum solutions.

Operating expenses rose to $30.4 million, up about 40% year-over-year, as the company continued to invest heavily in research and product development. The GAAP net loss widened to $140 million, mainly due to non-cash warrant-related charges, while the adjusted net loss narrowed to $18.1 million from $23.2 million a year ago.

Those investing in the quantum future aren’t expecting profits overnight. The bigger question is where D-Wave will stand a decade from now, a question that top investor Will Ebiefung is more interested in answering.

“D-Wave’s future will depend on the commercial viability of quantum computing technology within a reasonable timeframe,” explains the 5-star investor, who sits among the top 2% of stock pros covered by TipRanks.

Ebiefung points out that there is an enormous amount of hope regarding this developing technology, citing a McKinsey & Co. report predicting that the industry will generate close to $100 billion in revenues by 2035. The investor calculates that this would represent a “not too shabby” CAGR of 63% over the coming decade.

Though the company is making some sales – including a 10 million Euro agreement in October with Swiss Quantum Technology – D-Wave is light years away from anywhere close to capitalizing on this putative trend.

“While D-Wave’s business seems to be picking up, it is still far from sustainable profitability,” notes Ebiefung.

That doesn’t mean the company is in any imminent danger, hastens the investor. With oodles of cash on its balance sheet ($836 million at the end of Q3), D-Wave has plenty of runway to continue developing its technologies. There are also rumblings of a potential investment from the U.S. government, which would provide further support.

While the potential for big bucks is clear, the investor also cautions that much of the long-term success already seems to be priced in.

“It’s hard to get excited about a stock with a price-to-sales (P/S) multiple of 336 compared to the S&P 500 average of just 3.45,” Ebiefung sums up. (To watch Will Ebiefung’s track record, click here)

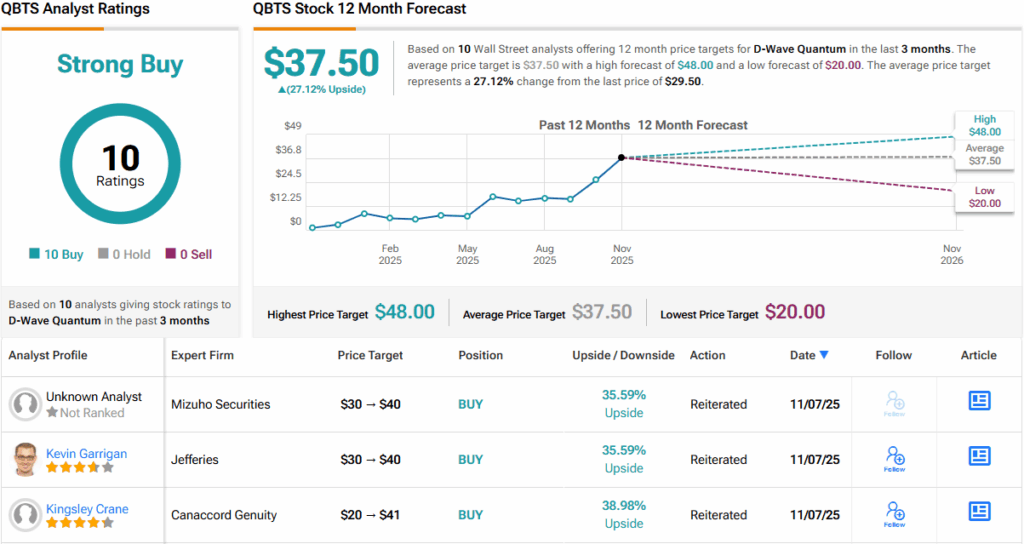

Wall Street, for its part, remains broadly optimistic. All 9 analysts covering QBTS rate the stock a Buy, with no Holds or Sells, giving it a Strong Buy consensus rating. The average 12-month price target of $37.50 implies a 27% upside for the next 12 months. (See QBTS stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.