Apparel maker Hanesbrands (NYSE:HBI) is well-known for its line of comfortable and reasonably attractive clothing that’s also friendly to the typical budget. But is it also proving friendly to activist investors? New reports suggest that may be the case, and investors are piling in, sending Hanesbrands up nearly 10% at one point in Wednesday afternoon trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The latest report from Activist Insight suggests that Hanesbrands may be in line for an activist to show up and take over. One of the biggest targets an activist might have within Hanesbrands is Champion, one of the biggest imprints that Hanesbrands has under its corporate umbrella. An activist might specifically choose to seek improvements in the Champion brand, focusing not only on modifying the marketing, but also on making general improvements in operations, recovering the lost dividend, and making Hanesbrands a better profit generator for investors.

It’s still not yet certain if such an activist even exists, let alone just how much value an activist investor actually even brings to the table to begin with. Further, with sales down 8% in 2022, and a fairly good chance that sales will fall again in 2023, that limits the amount of revenue to become capital in the first place. Without capital, Hanesbrands’ ability to affect much change—no matter what activist steps in if one even does—will be limited at best.

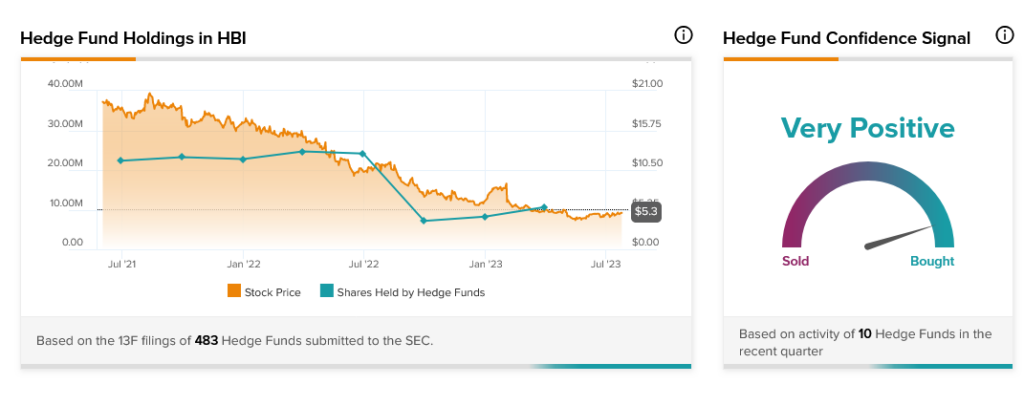

Hedge funds, however, are very much in support of Hanesbrands. Last quarter, hedge funds added 2.5 million shares to their overall holdings. That was enough to make hedge funds’ confidence rate “Very Positive” overall. Further, the latest quarter was also the second quarter in a row that hedge funds added to their holdings of Hanesbrands stock.