Halliburton Company (HAL) has bagged a 7-year contract to provide a complete range of customized chemical products and related services for a large immediate-or-cancel (IOC) order in Oman to support the in-field chemical treatments.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Shares of the products and services provider to the energy industry were down 2.9% to close at $21.45 on July 14.

Per the terms of the contract, Halliburton will be in charge of the production of crucial raw materials. Production will take place at the company’s new Halliburton Saudi Chemical Reaction plant, which is slated to open at the end of 2021. (See HAL stock charts on TipRanks)

Miguel Gonzalez, VP at Halliburton Multi-Chem, commented, “We are excited to provide our production chemical expertise and management services to help our customer maximize their asset value in Oman.”

He further added, “This collaboration aims to improve operational efficiencies and reliability by applying tailored solutions and close alignment between parties.”

Morgan Stanley analyst Connor Lynagh recently increased the price target to $28 (30.5% upside potential) from $23 and reiterated a Hold rating on the stock.

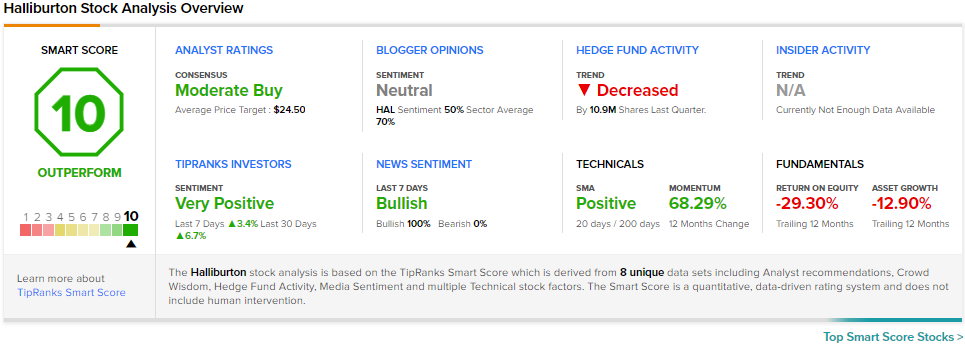

Consensus among analysts is a Moderate Buy based on 3 Buys and 6 Holds. The average Halliburton price target of $24.50 implies 14.2% upside potential to current levels.

Halliburton scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

PepsiCo Shares Jump 2.3% on Q2 Beat and Raised Guidance

Goldman Sachs Reports Blowout Q2 Results; Hikes Dividend by 60%

Organigram Bounces 11% on Q3 Revenue Beat