Haivision Systems (TSE: HAI) is a provider of infrastructure solutions for the video streaming market, servicing enterprises and governments globally.

It delivers high-quality, low latency, secure and reliable video through the entire IP video lifecycle, using a broad range of software, hardware, and services.

Earning Results

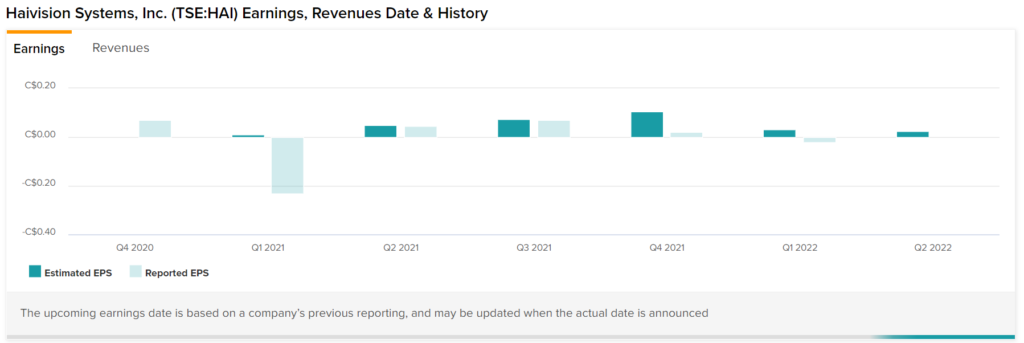

The company recently reported earnings for its second quarter. Earnings per share came in at -C$0.01, which was below the expectations of C$0.03. Since becoming a public company, Haivision has yet to produce a quarter in which it beat earnings expectations, as per the picture below:

Nevertheless, the company posted revenue of C$29.9 million, equating to a year-over-year increase of 36.8%. The increase in revenue is mainly attributable to the recent acquisitions of CineMassive Displays and Aviwest.

However, these acquisitions have also impacted the company’s gross margin, which has decreased from 78.1% to 71.4%. This is because CineMassive operates at a lower margin than Haivision.

In addition, adjusted EBITDA came in at C$2.6 million, representing a decrease of C$1 million compared to the prior period. This translates to a margin of 8.7% in Q2 2022 versus 16.5% in Q2 2021. Although lower relative to the prior year, it is the company’s 34th consecutive quarter of positive adjusted EBITDA. The stock is currently down 7.6% following its earnings release and an overall market sell-off.

Analyst Recommendations

Haivision has only received one analyst rating just over three months ago. Five-star Canaccord Genuity (TSE: CF) analyst Robert Young gave the stock an C$11 price target, which implies over 113% upside potential from current levels.

Final Thoughts

Haivision had a solid quarter in terms of revenue growth, primarily driven by its acquisitions. However, its profitability margins have seen a decline as a result. Nevertheless, the company’s earnings-per-share results tend to be volatile, thus, likely not making it the best choice for current market conditions.