Ride-sharing giant Lyft (NASDAQ:LYFT) lost better than 36% in Friday’s trading session. The biggest reason? A mixed-bag earnings report, coupled with guidance so sour some called it a “debacle.” That’s a terrible combination for any company, and Lyft proved no exception.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Lyft’s earnings report didn’t come in all that badly. Earnings proved a huge disappointment; Lyft posted a loss of $0.74 per share, while analysts were looking for a much smaller loss of $0.14 per share. However, Lyft managed to turn things around on revenue, coming in at $1.2 billion against projections that looked for $1.15 billion. Nevertheless, guidance faltered as Lyft looked for $975 million in revenue in 2023’s first quarter against the $1 billion outright projected by analysts, and analysts were not kind to the firm.

Wedbush’s Daniel Ives came out and suggested that Lyft’s results looked like management is “…playing darts blindfolded.” Ives also cut the stock’s rating to Hold and lowered the price target to $13 per share. Wells Fargo’s Brian Fitzgerald also cut the rating to Hold, as did J.P. Morgan’s Doug Anmuth, among others. Anmuth cut the price target on Lyft nearly in half, from $29 to $15, and even went so far as to note that “Uber’s (NASDAQ:UBER) network and scale benefits are increasingly weighing on Lyft’s execution.”

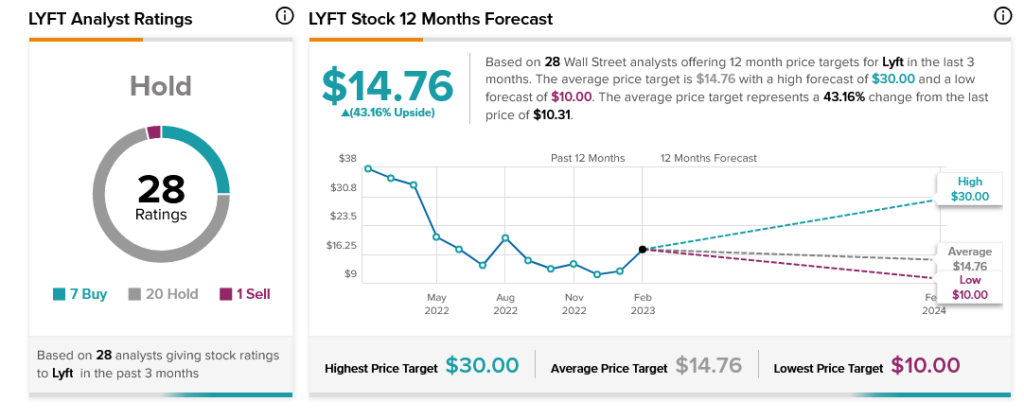

Overall, analyst consensus currently calls Lyft a Hold. Further, with an average price target of $14.76 per share, Lyft stock comes with 43.16% upside potential.